En español, en français, em português.

Is it possible to increase your ADR by reducing your rates? Certainly not. Then, why would you expect your discount-based loyalty program to increase your ADR? It’s counter intuitive and mathematically impossible. However, it’s somehow accepted by the hotel industry that loyalty increases your ADR. How would that be possible? Can we reconcile both statements?

A clarification to start. This post is about loyalty programs based on rewards (typically discounts) received on every booking without any need to wait for a certain condition such as minimum spend or time period.

Back to our challenge. According to some studies, loyal customers (members from now on) increase your overall ADR because they book higher category room types. Even that being a fact (and we’ll see it later), the positive impact in ADR hardly reaches 1%, very far from outweighing the associated discounts in these programs (from 5% to 10%).

It’s not the different room types what explains the higher ADR. It is the stay date that makes the difference. Members repeat more often than non-members and concentrate 10% their stays the high season, pushing their overall ADR high compared to non-members. But it’s not loyalty that drives that higher ADR but the underlying seasonality. After removing it from the analysis, the conclusion is different.

Think about it this way. If you manage to fill 100% of your hotel exclusively with members that enjoy a discount, will your ADR be higher? Certainly not.

You may like it or not, but loyalty programs do decrease your ADR

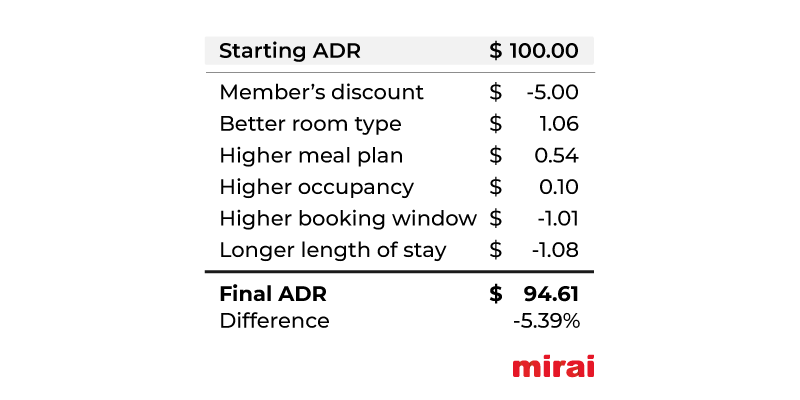

Once we compare same stay dates by members and non-members, we are back comparing apples with apples. We are ready to analyze how the different variables impact your ADR in both directions. We deep dived in our own data and got the following conclusions.

Variables that have a positive impact on the ADR:

- Room type mix. As stated above, on average, members book 4.34% of the times higher category rooms than non-members, increasing 1.06% the overall ADR. We should point out that this ADR increase only happens when occupancy is not 100% and you are selling a superior room instead of a standard one. However, if a hotel reaches 100% occupancy, that same superior room sold with a discount actually decreases your ADR.

- Meal plan mix. Regardless of whether you consider meal plans as F&B (food and beverages) or a room revenue, it’s revenue nonetheless. On average, members book higher meal plans (breakfast, half board, full board or all inclusive) 6.50% more times than non-members, increasing 0.54% the overall ADR.

- Occupancy. On average, members book rooms to fit more people 7.20% more times than non-members. The impact on the overall ADR is another increase of 0.10%.

Variables that negatively impact the ADR:

- Member’s discount: Hotels typically offer a 5% to 10% discount to their members. ADR is consequently impacted by this discount and decreased in the same proportion compared to bookings by non-members.

- Booking window: Members book, on average, 13.01% more days in advance than non-members. This higher booking window means a lower 1.01% ADR.

- Length of stay: Members book, on average, 10.15% longer stays than non-members decreasing the overall ADR in 1.08%.

Putting all variables together to see the lower ADR on members’ bookings

If we combine all variables in a simple model, this is how they play out. For this example, we set a 5% discount for members. Adding up the impact of all variables, the net result is down 5.39%.

Negative ADR but still worth it (positive net ADR)

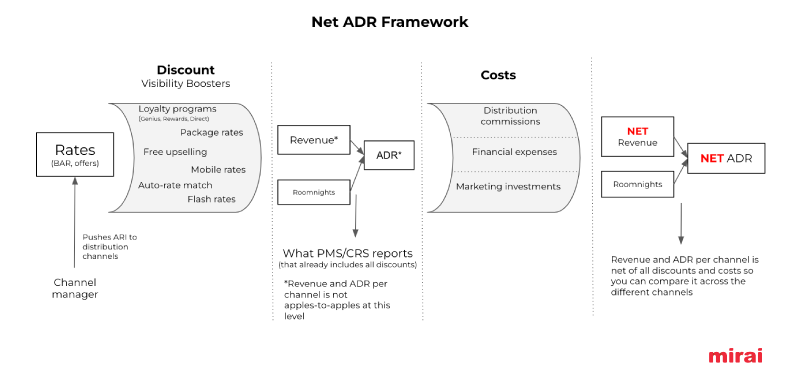

Remember that ADR is only half of the profitability equation. The other half is the associated cost, and here is where loyalty makes a huge difference. We need to take into account three types of costs: distribution, marketing and finance costs to convert ADR to net ADR.

Let’s analyze how loyalty affects each type of cost:

- Distribution costs. Does your direct technology differentiate the cost depending on who made the booking (member/non-member)? We’d argue it’s not a common practice. Therefore, we can assume that your direct distribution cost is the same.

- Marketing or acquisition costs. Driving customers for the first time to your direct channel requires time and money. We are talking about Google Ads, metasearch, social networks, display, prospecting, email marketing among many other initiatives. The average acquisition cost ranges from 4% to 8% of the total revenue generated directly, although it can go much higher, especially if you are bidding in the upper funnel. A hotel selling 1 million directly should be investing between 40k and 80k in online marketing.

And here we find the highest value of loyalty as it helps you drive your marketing costs close to zero. If done correctly, you should not need to spend all those marketing dollars anymore to capture your customers back. Creating a relationship with members requires work and money too, but this investment dilutes very fast when you add volume to your loyalty database.

Therefore, we could say that, on average, member bookings help you save 6% in marketing or acquisition costs.

- Finance costs. The cost of charging credit ranges from 2.0% to 3.5% depending on the country, card type and bank issuer. At first, whether the booker is a member or a non-member, does not affect this cost. However, loyalty makes a huge difference when it comes to chargebacks. Non-members dispute credit card charges five times more than members. Get your own number and estimate how much you would save by moving to loyalty.

From a lower ADR to a higher net ADR

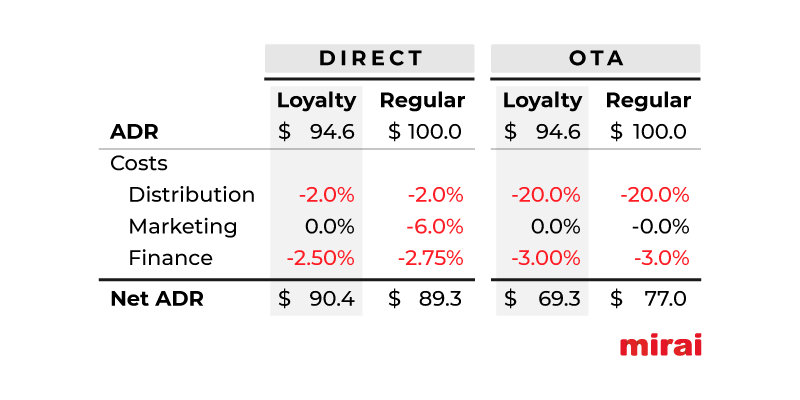

Putting all these cost variables together, loyalty proves that members’ bookings are, indeed, more profitable with a higher net ADR than non-members. Numbers look even better after comparing that profitability with the OTAs, especially when we take into account their loyalty programs such as Expedia Rewards (OneKeyCash) and Booking.com Genius.

Let’s make some assumptions and build an example. I would advise you to use your own numbers here.

- Distribution cost:

– Direct: 2% that does not vary depending on member/non-member.

– OTA: 20% commission.

- Marketing cost:

– Direct: 6% saved when the booker is a member.

– OTAs: 0% (you should add here the spent OTAs such as Expedia Travel Ads and Booking Network Sponsored Ads visibility boosters)

- Finance cost:

– Direct: 2.5% cost when charging credit cards. 10% more when booker is a non-member due to the higher chargebacks.

– OTA: 3.0% as OTAs tend to use Virtual Credit Cards (VCC).

Conclusion

Applying direct discounts to boost loyalty cannot increase your ADR. It’s mathematically impossible. Nevertheless, what really matters is that loyalty, in the end, helps you increase your net ADR, and this is the most important KPI for profitability.

With this conclusion in mind, hotels should start or keep pushing their loyalty programs, preventing at the same time OTAs from occupying this space with their own loyalty programs such as Booking Genius and Expedia Reward (OneKeyCash). Remember OTAs position these programs as a great tool for you when the reality is that they exclusively work on their own interest. Hotels should limit their exposure to these programs, understand how to use them short-term and eventually entirely move away from them in the long run.

You can learn more about loyalty here:

- Why your hotel or hotel chain should have a loyalty club

- Building customer loyalty through the direct channel, the unresolved issue