En español, en français, em português.

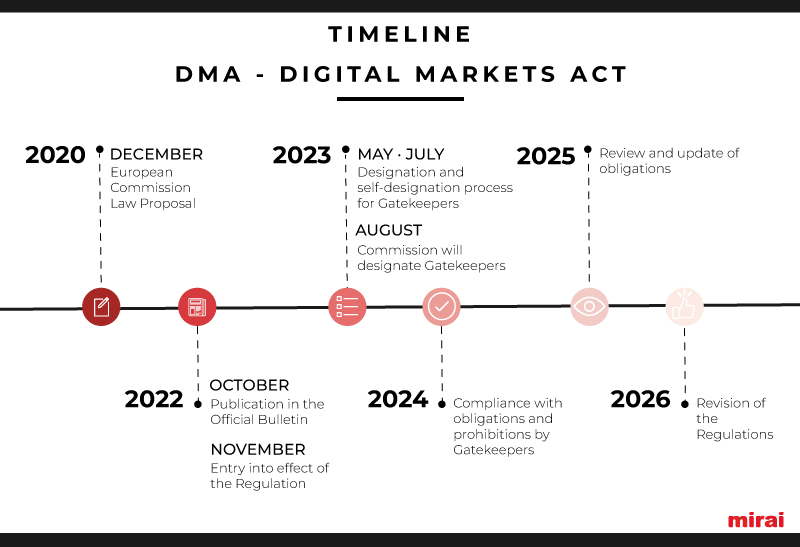

In December 2020, the European Commission introduced a regulatory framework known as the Digital Markets Act (DMA). The main objective of the DMA is to define regulations for digital markets that foster fair competition, and encourage innovation in the online economy, by creating a more balanced playing field for all the players in the digital ecosystem.

Despite implying a major upheaval in the rules of the game for electronic commerce, the change seems to have gone largely unnoticed for large parts of the media in general and for the hotel industry in particular.

Mirai has been closely and proactively monitoring the evolution of the regulations, and this post aims to provide valuable insight into what it means and its possible implications, especially given that the initial impacts of the legislation will begin to be seen in January 2024.

So what is the DMA and why does it affect you as a hotelier?

The DMA was proposed by the European Union (EU) to guarantee fair play in the digital environment and protect users. Its primary aim is to limit the power of companies that act as gatekeepers to the online platform economy and therefore control access to digital markets, ensuring they do not abuse their dominant market position.

The regulation therefore includes a number of obligations for gatekeepers and prohibits certain unfair practices. These include, for example, not favoring their own services over those of competitors on their platforms, not using data collected on their platforms to pursue unfair competition, or requiring them to provide vertical interoperability (allowing access and integration) with other platforms to allow fairer and more open competition.

Despite going largely unnoticed in the industry, these new regulations could have a major impact on the digital ecosystem for hotels. On the one hand, they will allow hoteliers to exercise greater control over their online distribution and negotiate fairer conditions with these online gatekeepers. On the other hand, the changes that gatekeepers will have to carry out to meet DMA requirements will have consequences that we are as yet unable to foresee, although we do foresee that the results will not always be what hoteliers expect.

Who does the European Commission consider online gatekeepers?

One of the key objectives of the DMA is to identify and control the major online platforms, the gatekeepers of access to electronic commerce. These platforms must meet certain criteria to be considered a gateway, including aspects such as the size and scope of the company’s services in the EU, its role as an intermediary between a large user base and a large number of businesses, and its potential long-term influence on the market.

A gatekeeper is more specifically defined as follows:

- A company that provides basic platform services in the European Union.

- A company with a size that impacts the internal market and is active in several EU countries.

- A company that is an important gateway for business users to reach final consumers.

- A company that has a significant influence on the way the digital marketplace works and a lasting effect on end users and businesses that depend on its platforms.

All of these criteria have been quantified[1] by the European Commission and thresholds have been defined for each of them. Gatekeepers may also be designated by the Commission itself, even though they do not meet all of the mentioned criteria[2].

Having defined who the gatekeepers are, let’s see the impact they may have on companies in the hotel industry:

- Greater transparency: platforms will have to be more transparent about how they rank and present accommodation options to users. This might lead to changes in their algorithms and policies.

- Data usage restrictions: restrictions on the way the platforms use the data they collect through their services. For example, gatekeepers may be stopped from using the data generated by a hotel to compete directly with that hotel.

- Increased interoperability and data portability: this means that a hotel might be able to easily move its listing and customer data from one platform to another.

- Unfair trade prohibitions: for example, platforms are prohibited from forcing hotels to offer the same rates on all platforms (rate parity clauses).

- Allow third-party access: for example, gatekeepers may have to allow other travel service providers access to their platforms to offer complementary services such as travel insurance.

The regulations also propose significant controls to guarantee compliance by gatekeepers, including regular monitoring. It also includes the possibility of severe penalties, the prohibition of specific practices and fines of up to 10% of the annual global turnover for serious breaches of the regulations.

This will interest you! Booking.com considers it is not a gatekeeper

During the application of the law, the European Commission named a number of online platforms as potential gatekeepers, giving each of them a deadline of July 3, 2023, to present their response. One day later, Booking.com published a press release announcing that it did not meet the DMA criteria to be considered a gatekeeper[3].

Based on the DMA criteria described above, from the point of view of hoteliers it makes no sense for Booking.com to try to position itself on the side of the “weakest links” in the value chain rather than accept its role as a company with significant control over users and their data, and a hegemonic position in the European market. This is even more apparent given that, by the end of this year, they expect to more than meet all the criteria contained in the DMA.

If the Commission accepts the self-assessment by Booking.com, the company would have an even more beneficial position within this new regulatory framework, avoiding the controls it will impose on gatekeepers, and benefiting from compliance by other major platforms such as Google, for example, allowing Booking.com to even further increase its market dominance and power over hoteliers.

As we have seen above, fortunately the regulations include the possibility of the European Commission designating gatekeepers regardless of whether they meet all of the criteria. This creates a glimmer of hope that Booking.com will be put in its rightful place together with other gatekeepers, leading to a change in the rules of the game that would give hoteliers greater control over their pricing and data, and creating greater potential for growth in direct sales.

Conclusion

The new Digital Markets Act is an important step forward in regulating the digital ecosystem and supporting both fair competition and user protection.

It has the potential to level the playing field for hoteliers and allow them to gain greater control over their online distribution and negotiate fairer agreements with online platforms. However, the fact that Booking.com considers it is not a gatekeeper raises many doubts about its compliance with the criteria and willingness to respond to the regulations imposed on gatekeepers.

This could give Booking.com an unfair advantage and further increase its market dominance and the dependence of many accommodation providers on its distribution services.

Taking into account the huge importance of the hotel industry in European countries such as Spain, France, Portugal or Greece, the incorrect application of the DMA gatekeeper concept might further restrict the ability of hotels to build up direct sales, and thus the profitability of hotels and the competitiveness of the entire hotel distribution ecosystem. Exactly the opposite of what the European Commission aims to ensure.

The potential implications of the DMA are still unclear, but it’s impossible to ignore that it will directly affect both the online distribution of accommodation and the way data is presented to final consumers, including through digital marketing or metasearch engines. The first changes caused by the regulations are just around the corner, and we will have to remain on our toes to make sure that hoteliers are not caught on the wrong foot. To be continued…

[1] Regulation (EU) 2022/1925 of the European Parliament and of the Council of September 14 on contestable and fair markets in the digital sector and amending Directives (EU) 2019/1937 and (EU) 2020/1828 (Digital Markets Act). Official Journal of the European Union, L-series 265/30-31, (chapter 2, article 3, paragraph 1. ) October 12, 2022

[2] As described in chapter 2, article 3, paragraph 8 of the Regulation

[3] In its statement, Booking.com claimed that the impact of COVID-19 on its business in 2020 meant that it did not reach the thresholds defined and could not therefore be considered a gatekeeper. However, by the end of 2023, this situation will have changed and they will more than meet the DMA thresholds.