En español, en français, em português.

Price is one of the key factors in any commercial transaction, whatever the product or service. In fact, for certain commodities with little differentiation, it is the main factor. Perhaps it is not always the most important in hotels, but it is certainly relevant. It is true that the more unique and luxurious the hotel, the less the price matters. But on the other hand, the less differentiated the hotel is from the competition and the lower its category, the more relevant price becomes.

Unlike during the search phase, price becomes a key factor once the customer has decided which hotel to visit and is working out which website they should use to make their booking (OTA or direct sales).

Is it possible to quantify the importance of price for your direct sales? How much are you losing by not controlling your prices and allowing other channels to sell cheaper than you do on your own website?

Basis of our study

We have analyzed the price competitiveness of almost 1,500 hotels on their own website against the price offered by OTAs for the same hotel during the second half of 2022, a fairly healthy period in terms of bookings.

All this data has been extracted from Google Hotel Ads, Google’s price comparison tool and source of a wealth of information. For each search/query made by a user, Google categorizes the results into four options it calls Price Buckets:

- Not lowest: Nice way of saying that your price is worse (with a 2% margin) than other OTAs. The number of these cases relative to the total is what we call %Lose.

- Tied for lowest: You have the best price in parity with other OTAs for your product.

- Unique lowest: You have the best price and you are the only one offering that price (the others have a higher price).

- Only partner shown: You are the only alternative, there are no other options selling your product for those dates (all other channels are closed).

We have downloaded all the enquiries made for all these hotels (10 million impressions), aggregating all the information and grouping them into each of these four buckets. We have decided to analyze only the data related to “Traveller-set dates“, which is when the end-user interacts with the dates and shows a clear interest (the alternative of “Default dates” includes many cases where there is no real interest shown by the end-customer, who may have been looking for something else).

Hotels are still not controlling their prices

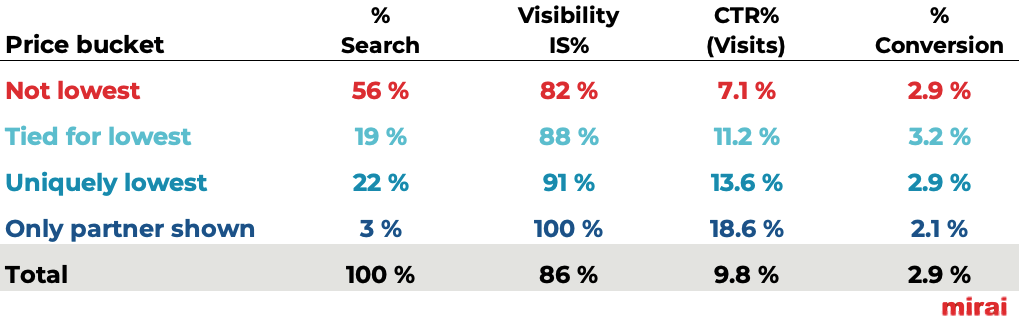

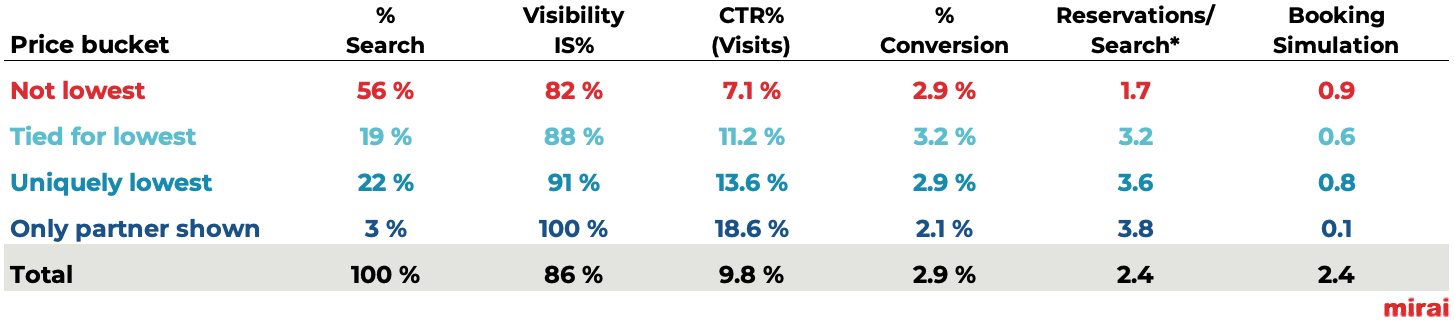

As you can see in the table below, in 56% of the inquiries there was one or several OTAs that offered a better price than the official website. Unfortunately, Google doesn’t tell us who, so in this case it doesn’t matter whether it is a third-rate pirate OTA (there are many of them) or Booking.com or Expedia. As you can imagine, the impact is not the same. Still, it’s bad news that hotels are still not getting the price under control.

In 19% of the cases there was real parity, and in 22% of the cases the hotel was offering the best price on its website. The last 3% are those brave ones that offered rooms on their website when the other OTAs were closed.

The better the price, the more visibility, more visits, more conversion and more bookings

The most fascinating and neat thing about the table above is the obvious correlation between price buckets and the three fundamental, invaluable variables for the direct channel:

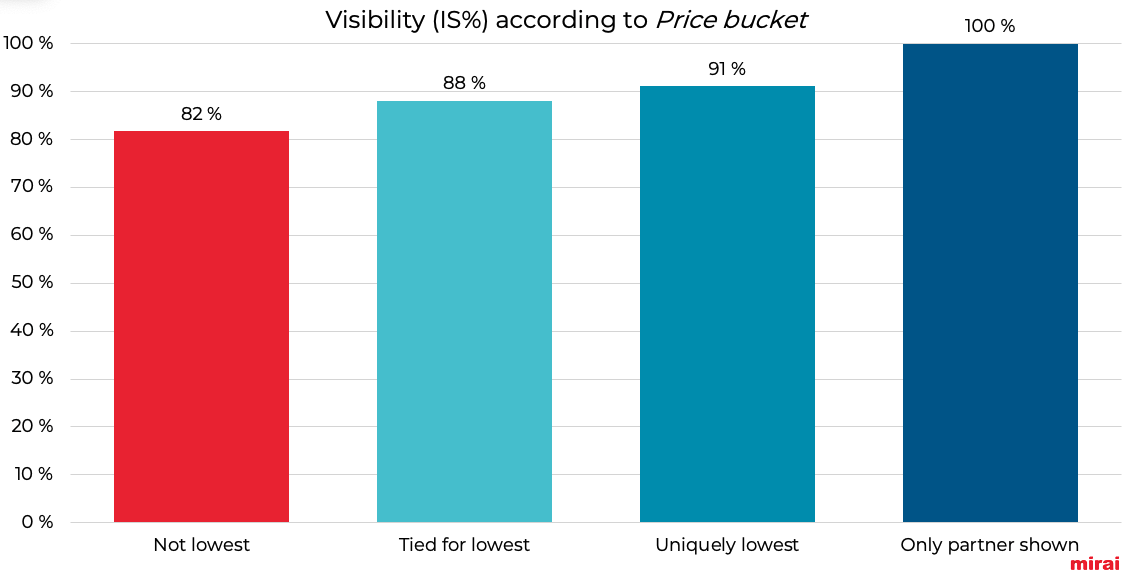

- Up to 22% more impressions (visibility), reflected in impression share, IS% (percentage of times the hotel appears in the results on Google, which largely depends on the bid and the price).

It clearly improves with competitiveness, which is logical because Google’s algorithm takes the prices of different advertisers into account when settling Hotel Ads auctions.

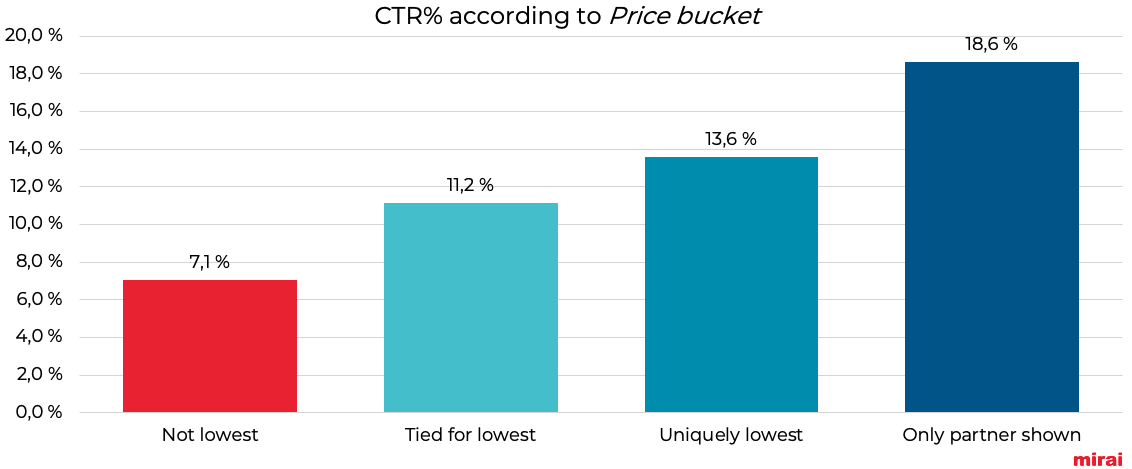

- Up to almost 3 times more visits, reflected in the CTR% (Click Through Rate, the number of clicks the hotel gets for every 100 times it is visible, which depends on the previous variable).

Here, the improvement is even more noticeable. Users tend to click more often when the price is more competitive. The difference between a scenario with a worse price than the others, versus the best price, is almost double! (7.1% vs 13.6%). Keep in mind that every click on this step means a visit to your website, which you can turn into a booking if you do things right.

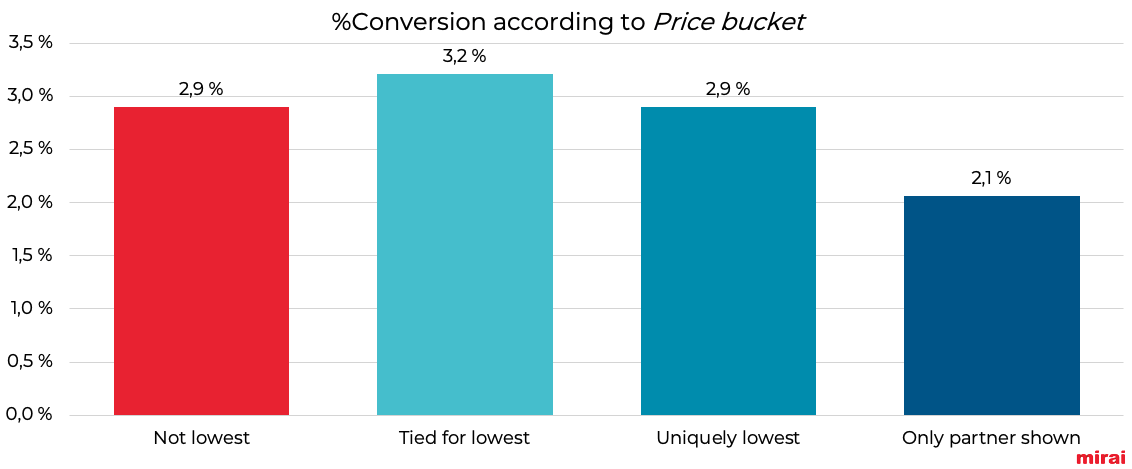

- Conversion, measured as the percentage of clicks (visits to your website) that convert into bookings.

In this case, the parity scenario has the best conversion rate, “Unique lowest” converts the same, and when only the hotel appears, it converts slightly less. This scenario only accounts for 3% of the cases in our data and is mostly related to periods of high occupancy and very high prices, which naturally lowers the conversion rate. In addition, the fact that no major distributor appears (at any price) may cause the end customer to have some qualms and take a little more time to decide.

- Up to 43% more bookings

By combining the three variables above, we can infer the bookings that can be achieved in each bucket. For example in the “Tied for lowest” case, let’s assume:

1,000 searches

… 88% impression share = 880 impressions

… 11.2% click-through-rate = 99 clicks (visits)

… 3.2% conversion rate = 3.2 bookings per 1,000 searches

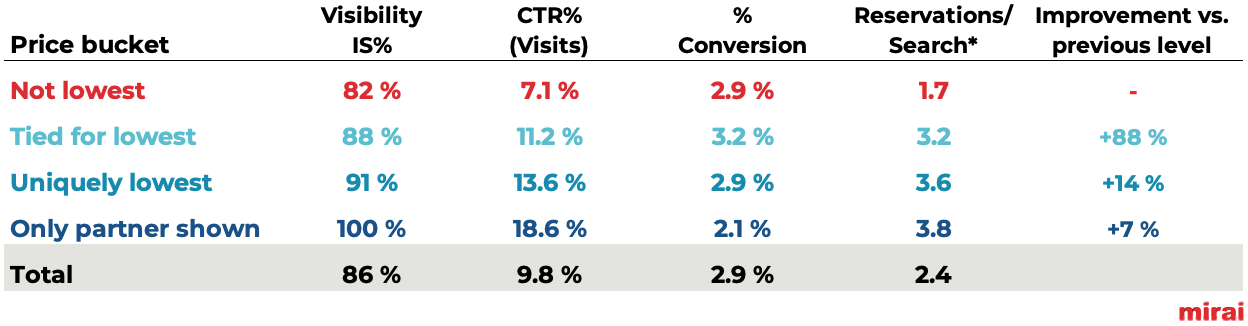

Repeating the exercise for each bucket looks like this:

*For ease of interpretation/analysis we have calculated it per 1,000 searches and added the percentage improvement over the previous price bucket in the next column.

It seems clear that the more competitive our price is, the more we will be able to sell on our website. The main qualitative leap is from the worst-case scenario (“Not lowest”) to a parity scenario (“Tied”), which yields an 87% increase in bookings over the baseline scenario.

If we simulate 1,000 searches with the data from the analysis and move the 56% of “Not lowest” cases to “Tied” (which had 19%), 75% of the cases will still be at parity, which would generate 2.4 bookings. These bookings would be in addition to the 0.8 from the 22% of searches with the best price for the hotel (“Unique lowest”) and the 0.1 from the 3% of “Only partner shown” cases. This totals 3.3 bookings, compared to 2.4 in the baseline scenario, which translates into a 34% increase in total direct bookings!

Doing the same exercise but moving all those searches to a scenario where your website has a better price than the other channels (“Unique lowest”), the increase in bookings reaches 43%!

The relationship between price competitiveness with respect to distributors and conversion of your website

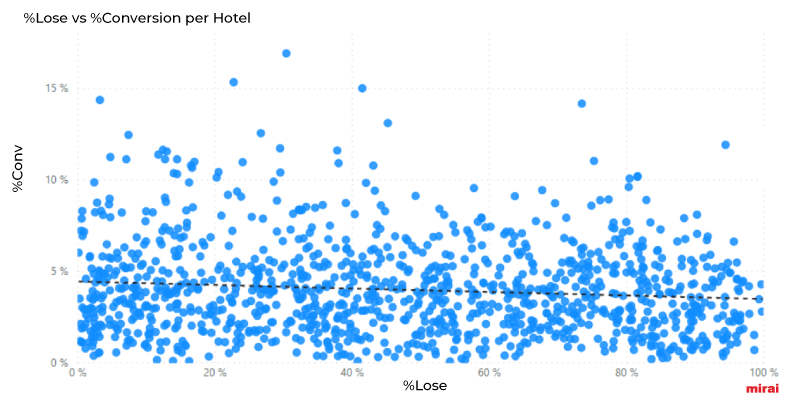

In the analysis above, the relationship between these two variables is not very clear, so we have taken data at the hotel level and put it on a scatter plot (each point is a hotel) to see if we can find any correlation between price competitiveness (%Lose) and the Conversion percentage at the hotel level:

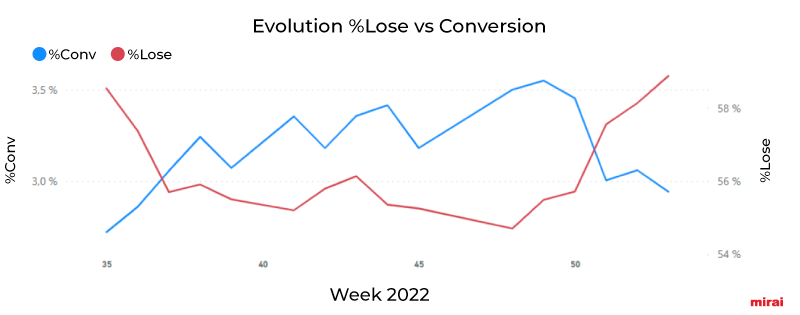

The fact that the dashed line illustrating the relationship between the two factors is descending means that, when the %Lose increases (that is, when competitiveness worsens), the conversion rate decreases. We already have a fairly clear first indication, but we will continue to look at the evolution of both indicators (aggregated weekly for ease of interpretation) over time (from week 35 to the end of 2022) for all these hotels together. What happens when competitiveness improves (that is, when %Lose goes down), and vice-versa?

Looking at this second graph, it seems clear that there is an inverse correlation between these two factors. When %Lose goes down, that is, competitiveness improves (until about week 48), the Conversion rate goes up. And conversely, when disparities go up (less competitive hotel), conversion goes down.

Therefore, it seems reasonable to state that, by lowering unfavorable price disparities with the OTAs selling your product, you improve the conversion of your direct sales.

How do you get your own price competitiveness data?

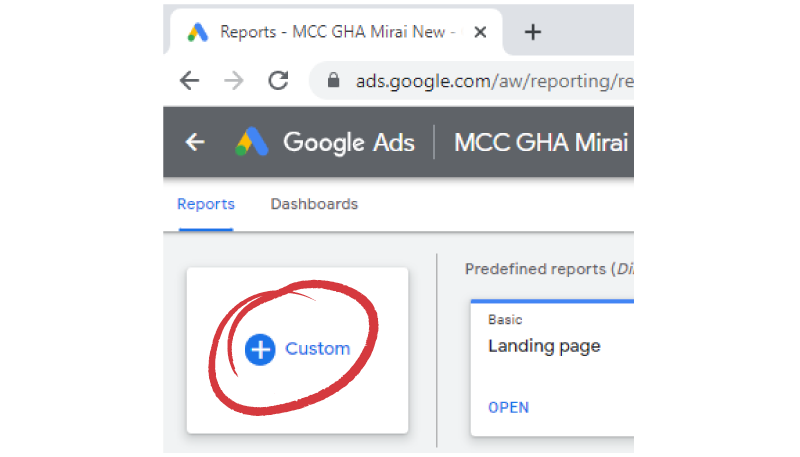

Access the Google Ads platform and go to the Reports section.

Click on “Custom” and create a data table where you should at least add the following:

- Variables: Day, User location, Device, Price bucket.

- Metrics: Hotel eligible impressions, Impressions, Clicks and Conversions.

With this information, you can create a report where you can analyze how competitive your prices are in different markets, devices, etc. If you are not sure, ask whoever provides you with metasearch connectivity. In the BI tool of the Mirai booking engine, we have had specific reports to track the price competitiveness of direct sales for some time now.

What can you do to improve your competitiveness and sell more?

This question could be the subject of another post, but we think it would be interesting to recapitulate the keys to “closing the circle” in this one. Remember that it is not only a question of price, you can also adjust the product, its availability and the conditions:

– Product and availability:

You decide which rooms and which packages you share with the different distributors and which you reserve for your direct sales. It is common to limit certain room types either because there are only a few units (e.g., a special suite) or because they are almost all sold out. It is also quite common to only offer Room Only in direct sales and to distribute minimum AD.

– Conditions:

It is common to offer benefits and a little more flexibility to your direct customers, especially those who are part of your loyalty programme. Some of the most common are:

- Early check-in/Late check-out

- Welcome gifts, courtesies

- Payment facilities (e.g., payment in instalments)

- Looser deadlines and lower penalties

- Greater flexibility in changes (and on Non-Refundable fares)

- Priority in room selection/assignment

– Price:

It is common for the distributor to change the agreed price, giving up part of its margin in order to be more competitive and get more bookings. With the advance of technology (and the proliferation of wholesalers/Bedbanks and their connectivity), there are many distributors with very low transaction costs which need very low commissions to cover costs. That is why they seek to maximize bookings even with tiny commissions, which is fine for them but detrimental to your direct sales. It is important to know in detail who is distributing your product and at what prices in order to make informed decisions and seek a balance that protects/maximizes your revenues.

In any case, we also recommend “grabbing the bull by the horns” by offering a real best price guarantee, including implementing a price-matching functionality on your website when necessary. It is also common to offer the best price to all customers who join your club.

Conclusion

Every time you manage to reduce disparities and improve your pricing, you are almost automatically going to get more impressions, more clicks (visits) and more direct sales bookings. A simple simulation with aggregate data reveals up to 43% additional bookings!

There seems to be a clear relationship between the competitiveness of your direct prices and the conversion of your website: by reducing unfavorable price disparities with OTAs selling your product, you will improve the conversion of your direct sales.

At Mirai, we have been helping hotels optimize their distribution and maximize their direct sales in a sustainable, controlled way for several decades. We do this with first-class technological solutions, and now with Mirai Consulting as well, our independent consultancy service that is detached from our technological solutions.