En español, en français, em português.

It’s nothing new that Google Hotels has become the most relevant metasearch player, with nearly 85% share in 2022. Most hotels can see this in their own figures. There are a number of reasons for this success: new placements for Google Hotels in search results and maps, the first metasearch to add a commission program participation model for hotels, and many new features for users that reduce friction in their search and booking experience.

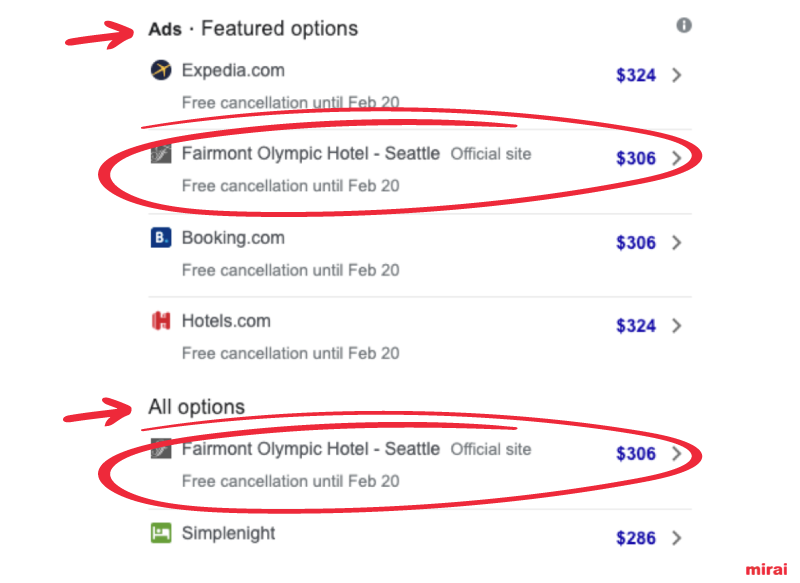

However, one of the most disruptive features launched recently by Google was free booking links, in March 2021. Suddenly, hotels had a new and free place to display their direct rates. What’s more, in most cases, the direct entry occupies the first position within the organic results, increasing the visibility of the direct channel in a highly visible and free placement. We should be cautious though, because Google has never officially stated that this first position is reserved for the direct channel, so it could change at any time. On initial inspection, many hotels that did not participate in Hotel Ads also appeared. As a result, customers can easily find direct rates for many hotels worldwide by simply searching in Google.

Increasing contribution of Google Hotels to direct bookings

Before we start, let’s review some important dates to better understand the numbers we’ll see below:

- March 2021. Google launches free booking links worldwide, but only on the Google Travel page, not on maps and search results.

- March 2022. Google extends the reach of free booking links to maps and search results.

To understand how the contribution of Google Hotels (both paid and free) has evolved over time, we split our set of hotels in two: those that have had active campaigns for the past few years, and those that have never had paid campaigns and only appear with free booking links.

- Hotels with paid campaigns (and free booking links)

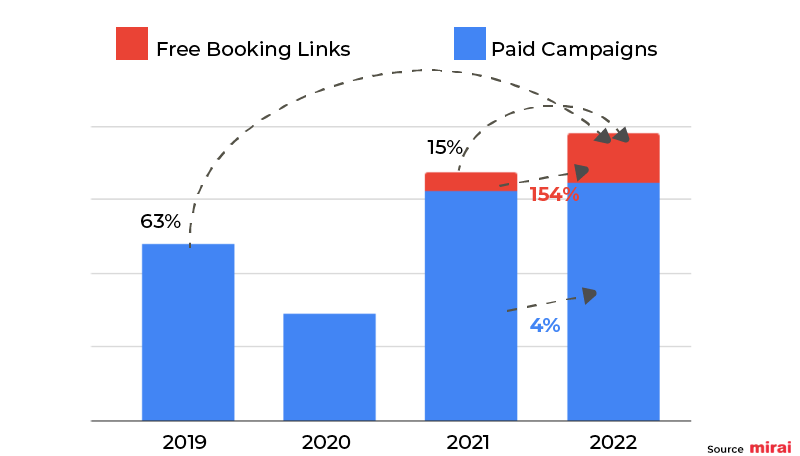

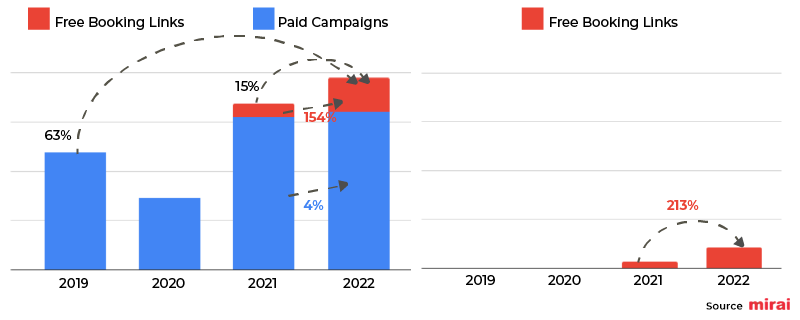

We selected more than 650 hotels that have had active paid campaigns in Google Hotel Ads for, at least, the last four years. For these hotels, the contribution from Google Hotels increased and generated more bookings each year, with the sole exception of 2020 due to the pandemic.

– Bookings from paid campaigns increased by 4% in 2022, accounting for 82% of bookings.

– Bookings exclusively from free booking links grew 154%, accounting for the other 18% of all Google Hotels bookings in 2022.

– 2022 ended with 15% more total bookings than 2021, and 63% more than 2019. Despite some potential cannibalization between free and paid links, the sum of the two is growing, and that’s what matters to hotels.

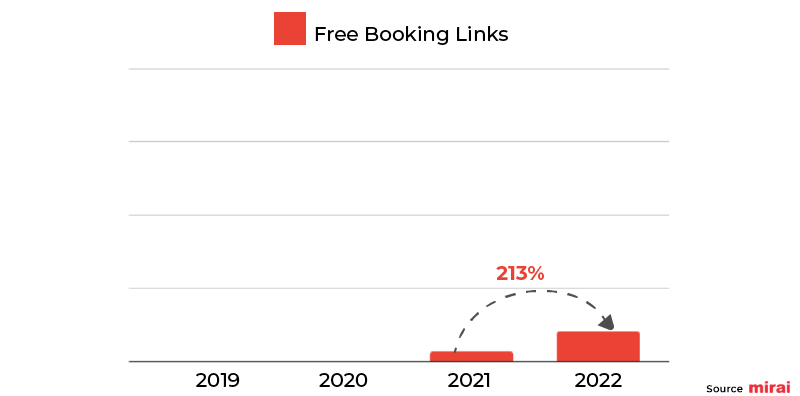

- Hotels participating in Google Hotels only with free booking links

We analyzed more than 250 hotels that have never had any paid campaigns on Hotel Ads. Therefore, the entire Google Hotels’ contribution comes from free booking links. We see a strong increase of 213% in 2022, very much in line with the growth of hotels participating in campaigns. This impressive growth is the result of Google expanding free booking links to search and maps in March 2022.

The beauty for these hotels is that these generated bookings are mostly incremental, as there is no cannibalization within Hotel Ads, although there could be some potential cannibalization with traditional search results (both ads and organic).

- Comparing the two sets of hotels

It would be unfair to compare the absolute number of bookings from one set to the other, as the numbers are very different. Hotels with active paid campaigns tend to be larger and more sophisticated than those that only participate with free booking links. They are also more likely to invest heavily in other online marketing placements, such as Google Ads and other metasearch players.

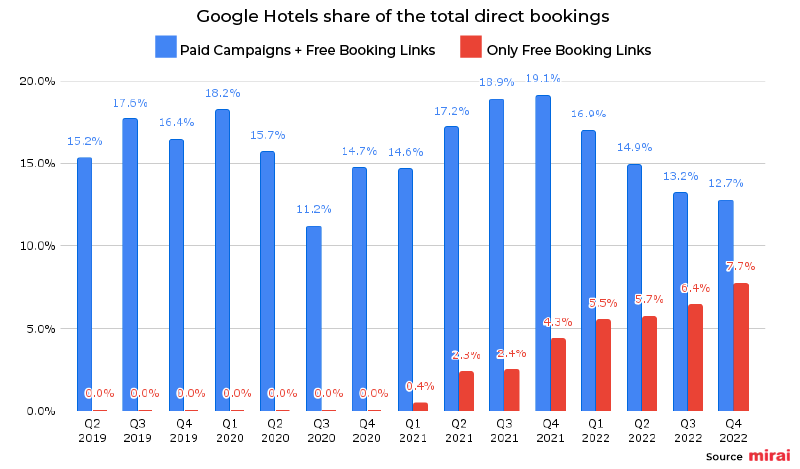

What we can compare, however, is the share of bookings coming from Google Hotels in both sets. We can see that the contribution of free booking links is growing rapidly for those hotels without paid campaigns. These hotels typically do not invest in online marketing, so free booking links are their best chance to compete with OTAs in Google Hotels. A growing share up to 7.7% in Q4 2022 is definitely good news for these hotels. Remember this number was 0% in 2020.

For those hotels investing in paid campaigns, the picture is quite different, although not in a negative way. Despite a 15% growth in the number of bookings generated by Google Hotels in 2022, we see a declining share starting in Q4 2021. This is because the total number of direct bookings grew at a higher rate than those coming from Google Hotels. A major reason is that these hotels literally doubled their investment in Google Ads in 2022, compared to 2019 (they barely invested anything in 2020 and 2021), shifting traffic and bookings from other sources back to Ads. There are other reasons, which we analyzed in this other post.

Differences between paid and free traffic and bookings

Does the customer behave differently when clicking on paid or free links? What’s the impact on the conversion rate? What about ADR, length of stay and booking window? Are mobile bookings different?

Looking at the results below for Google Hotels, you might not expect significant differences between paid and free links. But the numbers prove us wrong.

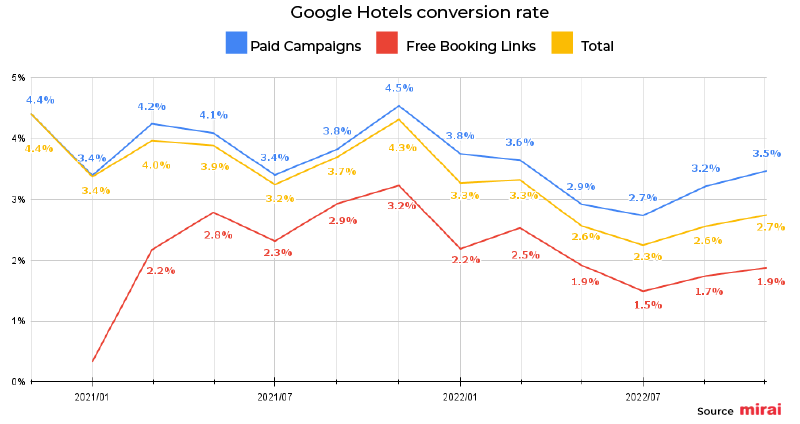

- Paid links convert 62% higher than free booking links

In our first analysis back in May 2021, just three months after the launch of the free booking links, the conversion rate was 64% higher on paid links than on free ones. We repeated the analysis, using the same number of properties (more than 900), over the last two years. The conversion rate trend seems to have consolidated over time, with a 62% higher ratio for paid than for free booking links. It seems that customers who click on paid links are lower in the funnel (closer to the decision to book) than those who click on free booking links.

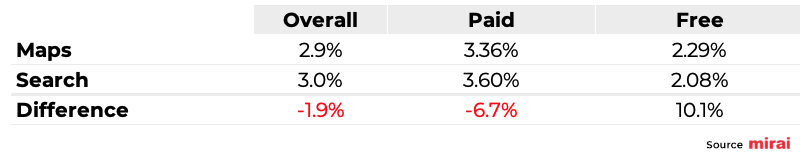

If we break down the conversion rate, according to the placement of Google Hotels within the Google ecosystem (maps or search results), we also find some small differences. While paid campaigns convert slightly better in search results than in maps (3.60% vs. 3.36%), free booking links have a higher conversion rate in maps (2.29% vs. 2.08%).

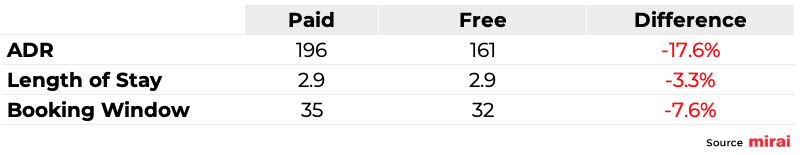

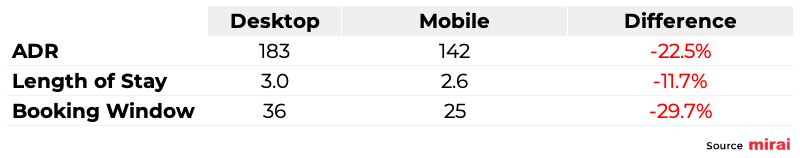

- Bookings coming from paid links have a 17% higher ADR, although differences in mobile share (where there is more mobile presence in the free links) is undoubtedly conditioning this price difference.

We aggregated all 2022 bookings and analyzed traditional hotel KPIs, based on whether the reservation came from a paid campaign or free booking links. As we can see, reservations coming from free booking links have a lower ADR, but very similar length of stay and booking window. We should be cautious though, because this different ADR is partly due to a higher mobile share on free links than on paid ones, which pushes the overall ADR on free links down.

- Desktop still generates more bookings, but mobile is catching up fast

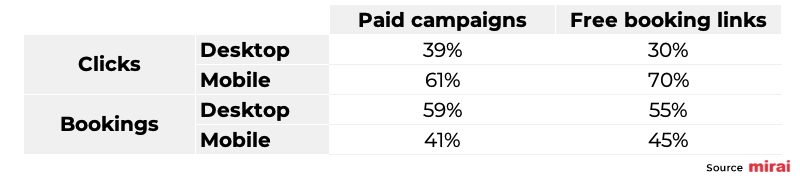

Mobile is dominant for both paid and free booking links. However, the mobile share is lower for paid links (61%) compared to free links (70%). Visibility of paid campaigns on mobile tends to be lower due to strong competition from OTAs, leaving free booking links as the only available option in many cases. In addition, other placements, such as Price Graphs (where only paid clicks are available), may drive more clicks on desktop than on mobile.

When converting clicks to bookings, we see a big shift in the numbers, with desktop still having the highest share for both paid campaigns (59%) and free booking links (55%). The conversion rate on mobile is 60% lower than desktop, reinforcing that mobile customers are typically higher in the funnel and still playing around with where to go and what hotel to book. ADR, length of stay and booking window are also lower on mobile, as we can see in the table below:

Conclusion

It’s clear that Google Hotels have become a critical source of traffic and revenue for the direct channel for most hotels. Both paid campaigns and free booking links are important parts of Google Hotels. They coexist in the same ecosystem and compete for the same customers. However, as our numbers suggest, they play in slightly different parts of the funnel. Therefore, it seems like a good idea to have both running, so you can target your customers at all times.

In any case, as a hotel marketer, it is your responsibility to understand Google Hotels, how paid campaigns and free booking links work, where they can take you, and how to get the most out of each feature. Don’t forget that the OTAs have mastered how to appear in all of these placements (while you foot the bill), and that’s part of their great success.

About Mirai Metasearch

Mirai Metasearch connects your hotel to metasearch engines, achieving higher profitability than sales generated through OTAs. For more information, contact us at metasales@mirai.com

About Mirai Consulting

Our consultancy and support service for hotels looking to take their distribution and direct sales to the next level. More information at consulting@mirai.com.