En español, en français, em português.

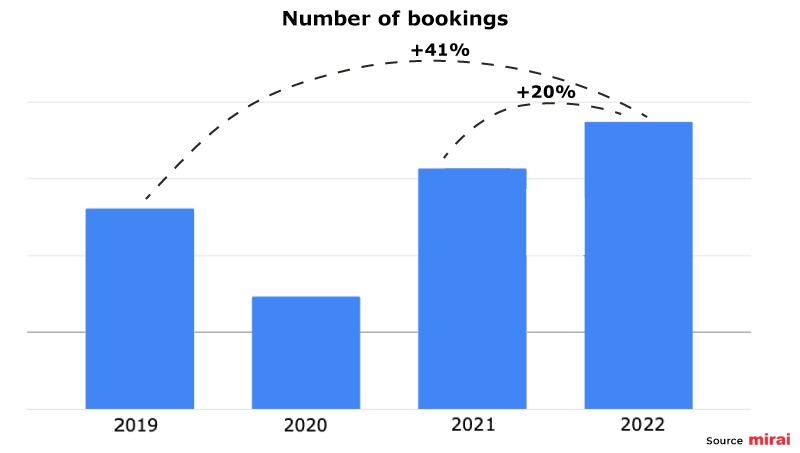

Since its inception a decade ago, metasearch has become an important source of revenue for the direct hotel channel. Its contribution to the number of bookings has grown steadily, except in 2020 due to the global pandemic, only to rebound strongly the following year. 2022 ended with 20% more bookings coming from metasearch than in 2021 and 41% more than in 2019.

At the end of this post, we explain where we obtained these figures and the attribution model we used.

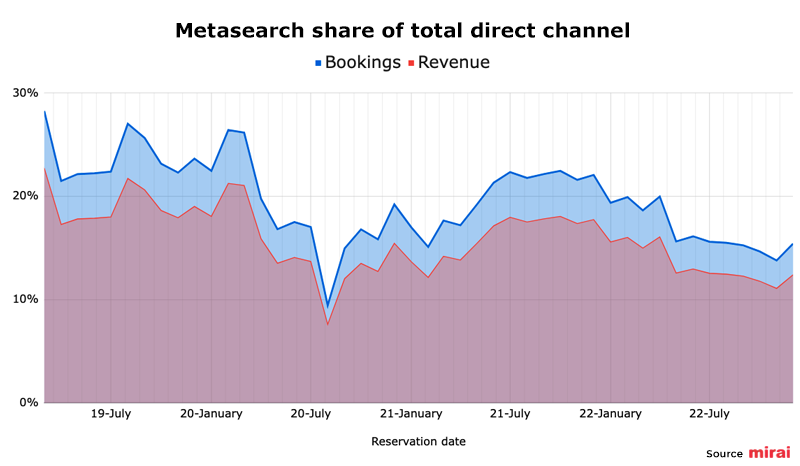

Growing metasearch contribution but declining share

Despite this 41% growth in direct bookings from the metasearch channel between 2019 and 2022, its share of the total number of bookings fell from 23.1% to 16.4%, a 30% decline. In terms of revenue generated, the share fell from 18.5% to 13.2%. This is because metasearch bookings have, on average, an 11.4% lower ADR and a 7.7% lower length of stay, resulting in a 19.6% lower average booking value.

Why is the number of metasearch bookings growing but its share falling?

Although the number of metasearch bookings grew by 41% between 2019 and 2022, the total number of direct bookings grew at a much higher rate of 98%, diluting the share of metasearch bookings. Four reasons help to explain this phenomenon.

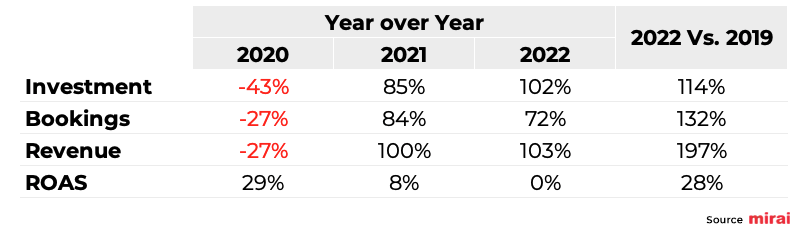

- Rising investment in digital marketing. Many hotels have finally understood that they need to show their direct channels where their customers are searching and clicking. In 2022, hotels invested 114% more in Google Ads and generated 132% more bookings than in 2019. This is a much faster rate of growth than the 41% increase in metasearch bookings.

- The surge in direct bookings during Covid-19. The pandemic had a tsunami effect on many hotels, driving many bookings from offline to online channels. Consumers learned that the direct channel wasn’t just a good place to get the most accurate information, but also a good way to book. As a result, hotels received a large influx of visitors in 2022, which organically increased direct bookings. Since then, the direct channel has experienced an unprecedented sweet moment.

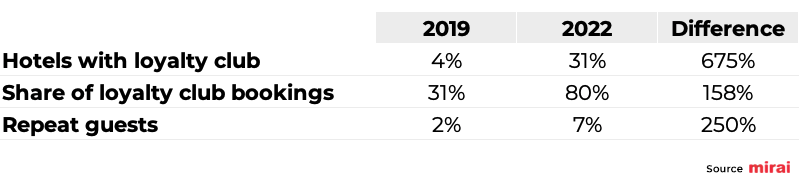

- Loyalty. Many hotels have finally responded by launching their own loyalty programs, rather than just participating in those offered by OTAs. These programs create real incentives to book directly, without the need for other marketing investments such as Google Ads or metasearch. In our analysis, 31% of hotels have a loyalty program in place in 2022, compared to only 4% that had one in 2019. In addition, better technology has helped convert 80% of all new customers (who made a booking) into members, compared to just 31% in 2019. As a result, customer databases are growing rapidly and repeat guest numbers are slowly following suit, creating a healthy base of direct bookings for years to come.

- Slower metasearch participation recovery. During the pandemic, most hotels stopped investing in online marketing, with the exception of placements that offered a true commission per stay (CPA) model, of which Google Hotel Ads was the only one at the time. trivago followed in early 2022 with its net CPA model. CPA models are convenient and risk-free models for hotels and many of them (especially independents) favor them over cost per click (CPC) options. Our data suggests that 58% of hotels that invested in meta back in 2019, mostly in CPC, have not resumed their campaigns in 2022. A somewhat contradictory fact, as many of these hotels have increased their Google Ads budgets at the same time.

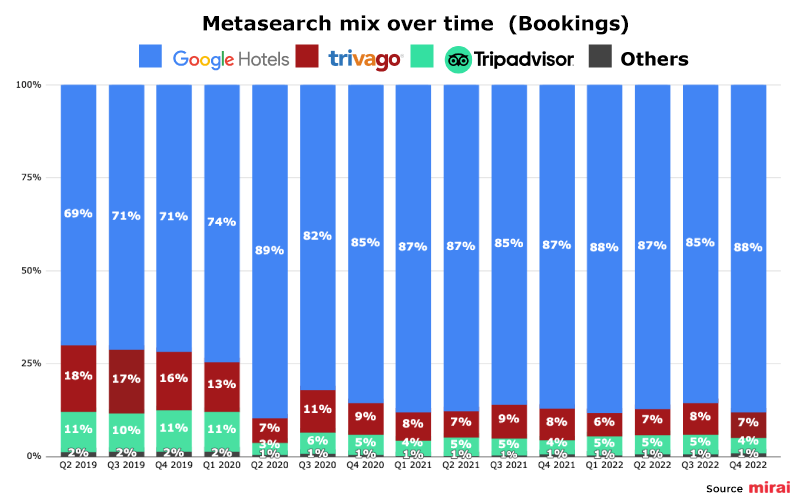

Google Hotels has increased its dominance

Back in 2019, we analyzed hotel investment in metasearch by player, concluding that Google Hotel Ads had become the most dominant with 67% of the spend. This new analysis is based on the contribution in terms of number of bookings (not investment), but it reaches the same conclusion: Google Hotels continues to gain share, jumping from low 70% values in 2019 to more than 85% in 2022. A major reason for this increase was the democratization of the commission program during the pandemic, which convinced many hotels to keep or add their properties to the program. After bottoming out in Q12022, both Tripadvisor and trivago are successfully fighting back and regaining some of their lost share. Falling cancellation rates and higher ADRs have restored some of the appetite for hotels to resume their campaigns in CPC models.

How did we calculate all these numbers?

Writing a post with figures can always be controversial, so we wanted to share how we arrived at all the numbers in our analysis to give some context. Averages are just that, and the numbers in any given hotel can be very different depending on many factors: destination, point of sale, customer profile and maturity of the hotels. I’d advise you to look at the trends rather than the exact numbers in this analysis, to compare them with your own data and to get ideas on how to improve your metasearch strategy in the future.

- Number of hotels analyzed: 944 hotels in total. 50% independent and 50% hotel chains with up to 50 properties. All of these hotels have continuously invested in metasearch from 2019 to 2022.

- Metasearch players: Google Hotels, Tripadvisor, trivago, Skyscanner and Kayak. Bing Hotel Ads was first introduced in 2022.

- Points of sale: The regions with the highest share of bookings were Western Europe with 53%, North America with 24%, Latin America with 16% and Asia with 5%.

- Attribution model: As mentioned above, we collected data using the “assisted attribution” model with a 30-day cookie lifetime. The purpose of this blog post is not so much to extract the exact data, but the trend over time.

Conclusion

Any source of traffic that generates 13% of total direct revenue is a must in your online marketing mix, and that’s what metasearch is today. Despite losing share in 2022, we predict it will regain share as digital marketing budgets stabilize, Google increases the visibility of Google Hotels, and other metasearch players facilitate the onboarding of more properties with commission-based participation models.

For those who are already investing in metasearch but are not happy with their results, remember that metasearch is not something you can plug, play and forget. You need the right integration technology, the right bid optimization strategy, the right booking engine and the right direct strategy. If you want to improve your results, you have no option but to make changes to one, two three or four of these variables.

Finally, for those hotels not participating in meta, are you sure you are not interested in a source of traffic that could generate 13% of your revenue?

About Mirai Metasearch

Mirai Metasearch connects your hotel to metasearch engines, achieving higher profitability than sales generated through OTAs. For more information, contact us at metasales@mirai.com

About Mirai Consulting

Our consultancy and support service for hotels looking to take their distribution and direct sales to the next level. More information at consulting@mirai.com.