It is surprising that hotel managers are satisfied with their online direct sales (through their websites) when they ought not to be as there is much room for improvement. Others, instead, are very dissatisfied without reason. Why these differences in perception? How do we determine if we are at an appropriate, or even an optimum level of direct sales?

To understand this, we need to compare not only with other sales channels but also with other hotels. The direct online sales channel is not isolated and is influenced to a high extent by other distribution channels. Therefore, conclusions should not be drawn based on absolute numbers. We should focus on comparative data from different channels.

Such an analysis will enable comparisons between very different hotels, which has been done in the past, albeit partially or incorrectly.

“Hotel only” versus “hotel + flight”

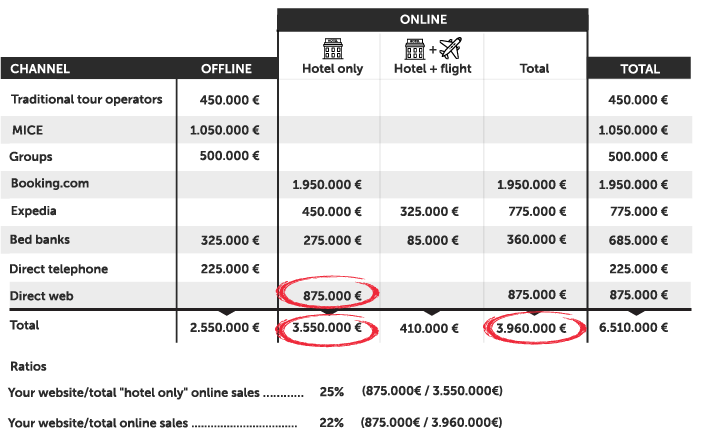

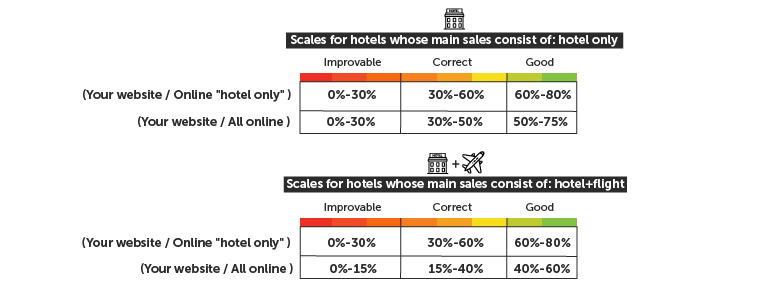

We will base our analysis on two comparisons. Firstly, we will measure the weight of our web sales compared with all non-package online sales (hotel only). Then we will do the same with all online sales, including packages (hotel + flight).

Why is this difference so important? Because direct web sales are usually “hotel only” and the natural competition comes from online channels that also sell the “hotel only” option. To increase direct sales, the first step is to take a look at these channels.

Do “hotel only” web sales compete with channels that sell packages? Of course, they do, albeit with different strategies and approaches. That is why we make an independent comparison.

Can the website sell “hotel + flight” packages? Yes, it can, but the technology required is expensive and is only affordable by large hotel chains. Failed attempts to sell packages on a website can be expensive and unsuccessful.

Why are some hotels and destinations sold more in “hotel + flight” packages than others? Don’t be tempted to think that some destinations, such as islands, are just because they are islands! Around 90% of visitors to destinations like Barcelona arrive by air (regular flights plus low cost). However, the rate of package sales is low. Connectivity obviously affects sales, but other variables such as the nature of the issuing market (the USA is very prone to booking packages) and ease, cost and safety between the airport and the hotel, are fundamental variables for “hotel only” sales to be successful. And of course, the most important factor is price. If hotels give better rates to sell their rooms through packages rather than solo, it is coherent that they sell more packages. Whether or not this is worthwhile is debatable.

Relativity between channels

Direct online sales versus “hotel only” online sales. This first analysis compares “hotel only” sales made on your website with those made on all channels with the exception of “hotel + flight” sales. This ratio will be particularly useful for hotels where packages have barely any weight (most of European urban destinations)

Which channels sell “hotel only”?

- OTAs. There’s no question that they dominate online sales. Booking.com is the leader, followed by Expedia.

- Bed banks. They allow their affiliates to sell non-packages, whereas a large portion of these come from pirate OTAs that systematically undercut prices.

- Tour operators. Online and non-package deals are not their usual sales method but this will grow in time if hotels fail to do not control this before this happens, particularly in respect with the exceptional rates they enjoy.

Direct online sales versus total online sales. Following the same analysis but taking all online sales, including “hotel + flight” packages, into account. This ratio adds information to that gathered in the previous analysis and is especially relevant for hotels that are more dependent on package sales, such as island holiday destinations (Spain and Greece), more so when the US issuing market is included (the Caribbean).

Which channels sell “hotel + flight”?

- OTAs. In this case, the leader is Expedia while the rest, with some local exceptions, have a residual market share on a global scale. Booking.com is expected to start selling packages soon, since they are already testing out packages to destinations like the Dominican Republic.

- Bed banks. They are able to offer package deals and may make some such sales.

- Tour operators. Several estimates show that between 50% and 80% of tour operators’ sales are made online. A figure alarmingly high that challenges the classic tour operator business model (do tour operators deserve better rates because they sell more? or do they sell more because they have better rates?). There are also wrongly-named “online tour operators” where every destination and issuing market has localised agents, such as Onthebeach and Travelrepublic in Europe and Cheapcaribbean in the US.

The figures

This analysis requires accurate data vis-a-vis sales per channel. Before you begin:

- Decide whether to use net or gross production but do not mix them.

- The same with board. Include all or none of them.

- To distinguish between “hotel only” and “package” sales, get a breakdown from each channel.

- Be wary of the those that don’t provide the information. Either it is not in their interests to share it, or they are hiding something. In cases like these, you will have to make assumptions according to the destination and the issuing market.

- If you are unsure, or receive no reply, remember that sales through bed banks are coming through fake OTAs that undercut prices and sell stand-alone deals.

- When it comes to traditional tour operators and in the interests of simplicity, you can start by estimating that online sales account for 0%, however, many studies show that the real situation is very different.

Once we have decided how to get the data, the calculation process is automatic

Is Booking.com your main channel? Your reference is the ratio “web/booking.com”

This is the usual scenario, at least in Europe and increasingly in the USA. We are talking about online “hotel only” sales where Booking.com continues to speed ahead (as opposed to package deal sales where Expedia dominates).

If this applies to you, you can look at the ratio of web sales and Booking.com sales, which is more direct and easier to calculate.

Room for improvement, correct or good?

The higher your percentages, the healthier your proportion of direct sales. In contrast, low numbers indicate that there is room for improvement and it’s time to roll up your sleeves and get to work.

Big brands, the exception

In the case of big brands, the weight of the brand, the confidence they generate and the strength of its loyalty programmes are pivotal and have a significant impact on the importance of each channel. Of course, it is only to be expected that brands like Marriott, Intercontinental, Accor and Meliá sell more via their websites than they do on all the OTAs put together. This would give them very much higher levels of ‘improvable”, acceptable and good scores.

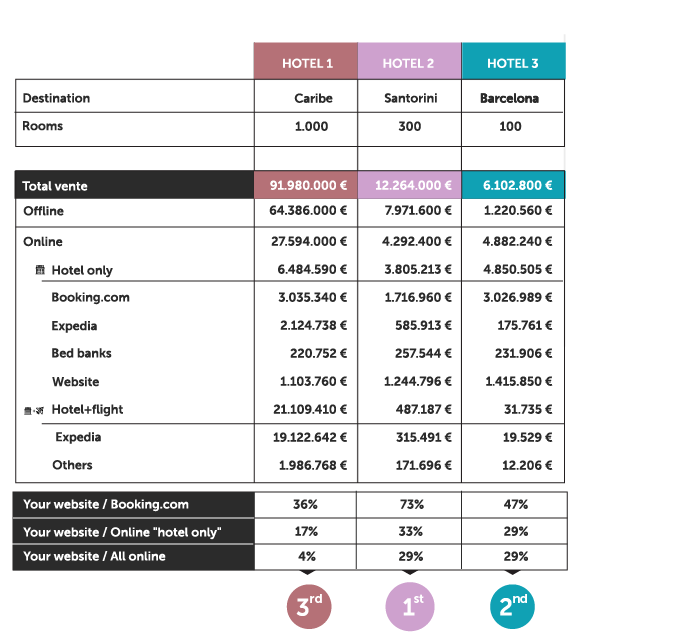

Compare different hotels

Another advantage of this analysis is that it allows us to compare very different hotels. As it is a relative data between online channels, we cancel the two variables that make it difficult to compare hotels: the number of rooms and the weight of offline sales.

In this example we compared three hotels, one in Barcelona (Spain) with 100 rooms with website sales of 1.4M with another in Santorini (Greece) with 300 rooms and 1.2M website sales and a much bigger one with 1,000 rooms in Cancún (Mexico) and just over 1M in website sales.

An analysis of these figures and the size of the hotels may suggest that the hotel in Barcelona is most successful in terms of website sales, however this is not the case. An analysis of the other channels shows that the hotel in Santorini has the best results of the three, although there is still room for improvement.

Direct sales and the impact of offline business

We have said very little about offline sales, since these do not tell us anything about the strength of direct sales. By offline, we tend to mean traditional tour operator customers and segments, groups, MICE, corporate or call centres, that come from traditional offline channels.

On the other hand, offline sales are important for ascertaining potential for growth in the direct channel. Hotels with high offline sales have little margin for the online world (and therefore, the direct web channel) to grow. In other words, to grow online, they need to reduce offline sales first.

But before moving from offline to online sales you must make sure that the net revpar (ideally the net revpar which would also account for other income and not just income from rooms) is higher than the margin you receive from offline channels. Moving from offline to online sales without performing this analysis is a common error as one tends to assume that it is more profitable, which is not always the case.

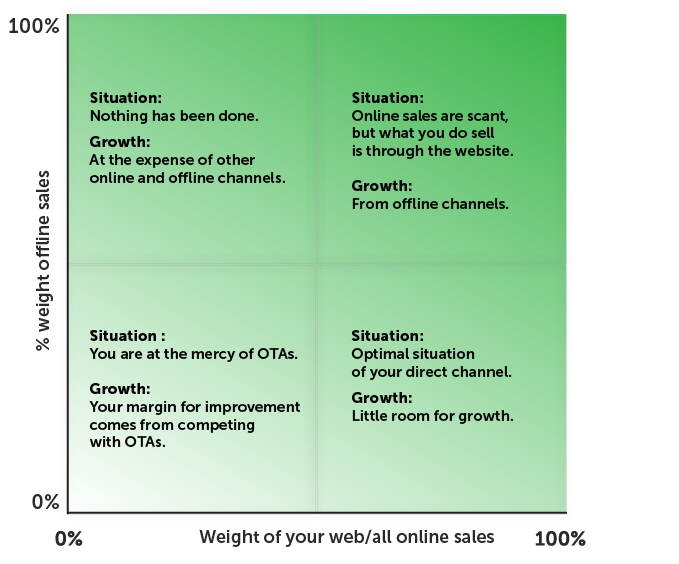

Crossing the weight of offline sales with the weight of website sales, particularly online sales, gives a clear picture of how to increase direct online sales.

Conclusion

In order to analyse direct sales data and its potential growth, subjective interpretations must be avoided, focusing instead on specific data about other channels. This exercise allows an accurate diagnosis of the health of direct online sales and enables us to compare our hotel with those of third parties or all hotels in the chain regardless of location and size.

Having an accurate baseline is the first step and will help us to assess the health of our direct channel. The goal is to progress, every year, towards a healthier mix of channels, with a focus on increasing direct sales to ensure a higher level of independence to address the many changes to come.