En español, en français, em português.

Why Black Friday matters (more than we think)

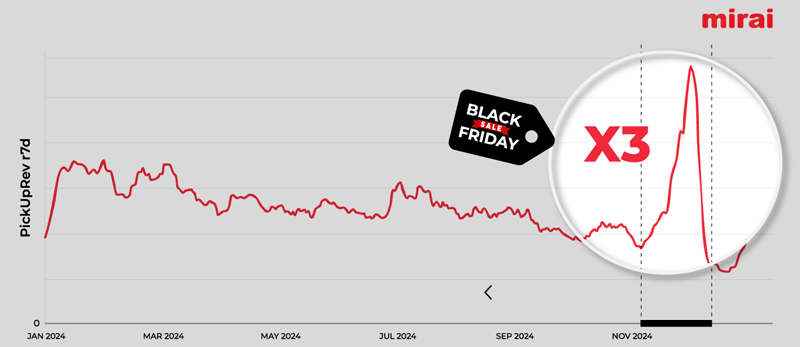

Black Friday is no longer a one‑day event. Year after year it has turned into a multi‑day campaign that reshapes purchase intent, a “dress rehearsal” that can even set the price you’ll later defend, impacting cancellations and your distribution mix. That’s why, measuring when the purchase happens and in which channel it materialises, is the foundation of profitability.

At Mirai, we typically analyse, together with our clients, both the direct channel and the rest of distributors, to design strategies that maximise direct sales and margin. With that lens, we studied Black Friday 2024 (20/11–03/12), crossing bookings by channel with daily and hourly granularity, cancellation rate, hotel typology, months of stay, marketing investment and ROAS, to understand what activates demand and how to capture it better in your own channel.

The impact of the campaign can be huge; just look at how our leading hotel chains grew their web sales versus the rest of the year during the last campaign. Are you really not going to seize the opportunity?

1. From Black Friday… to Fake Friday: rising interest

In recent years, Black Friday has stopped being a single sales day to become an extended campaign that can even start a week earlier. Google already identifies the “Fake Friday” phenomenon, the Friday before Black Friday, where search interest reaches up to 80% of Black Friday’s own volume, reflecting that users expect deals to start early.

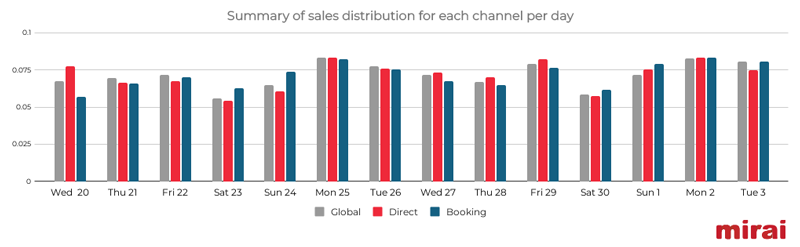

Action. Traffic data confirms this trend: Friday no longer concentrates all the interest; instead it spreads more evenly across the week. Days like Monday 24, Cyber Monday (Monday 1) and even Travel Tuesday (Tuesday 2) show levels that are very comparable to Black Friday itself. Ultimately, the campaign has turned into a two‑week marathon, where anticipation and continuity matter more than one‑day impulse. Plan your campaign accordingly.

2. Daily sales by channel: increasingly spread across more days

Here we break down each channel’s total sales by day. As noted above, the campaign shows a highly distributed sales pattern without a single peak concentrated on Black Friday. When we analyse sales by channel, we see the direct channel spreading its strength across several key moments (Nov 25–26, Nov 29 and Dec 1–3), showing great consistency. Booking remains stable on the same days, while Expedia concentrates bookings in the preceding week. Overall, behaviour confirms that Black Friday is now an extended period, not a day, and that the direct channel can go head‑to‑head with OTAs. In LATAM we see a slightly higher weight on Friday 29 itself.

Action. The best way to protect yourself throughout the campaign from OTA price tweaks (Booking Paga, Expedia’s EPS, other B2B…) is a price differential in favour of your website. If you don’t apply it generally, at least do it on the highest‑potential days, even combining it with adjustments in minimum stays, rate plans and OTA restrictions, so your web sales remain even more protected.

3. Cancellations: from 28% in the direct channel to 48% in Booking

In the last campaign we saw an average cancellation rate of 37% (Urban 38%, Resort 35%). The direct channel is clearly healthier (28%; Urban 16%, Resort 29%) versus Booking 48% and Expedia/other B2B 35%. In Booking, cancellations are systematically high in both urban and resort, with peaks the prior week (Nov 27–28 ≈50%) and overnight (many hours above 60%). Interestingly, Black Friday (Nov 29) is among the days with the lowest cancellation probability (~43%). In LATAM, similar rates are observed, even surpassing 50% in Booking with peaks of 56% on certain days.

Action. Activate a “cancellation shield” in Booking: set stricter cancellation and prepayment conditions, identify the rate plans with the highest cancellations and reduce their exposure in Booking by removing them or, at least, tightening conditions—leaving only what is costly for you to sell. Shift the rest to your direct channel with a stronger value proposition to sustain conversion and ADR while minimising cancellations.

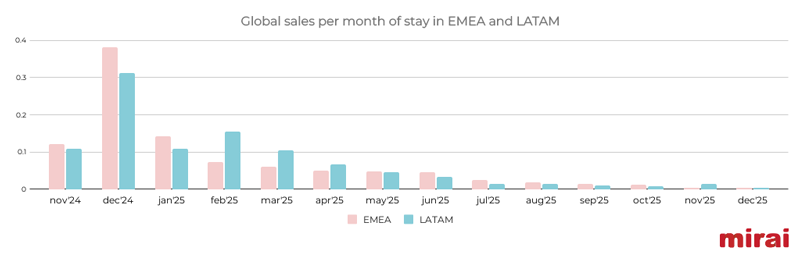

4. By month of stay: Black Friday de‑seasonalises and the direct channel sells summer

Across all hotels, the campaign concentrates stays mostly in December (≈38%), followed by January (≈14%) and November (≈12%); the rest tapers off progressively through autumn ’25, although in LATAM sales for February, March and April are somewhat higher for resort hotels. Across channels the shape is similar in Booking, direct and Expedia, with one nuance: the direct channel generates more than OTAs towards spring/summer.

By typology, Urban is ultra‑concentrated in December+January (≈56%) across channels. EMEA holiday destinations show a more seasonal distribution: the resort direct channel places nearly 3 out of every 10 stays between May and September (~29%), well above Booking (~14%) and also Expedia (~24%). Bottom line: the direct channel is especially effective at pre‑selling summer for resorts, whereas in urban hotels the battle is year‑end.

Action. In urban hotels, almost 1 in 2 bookings is for December stays. If your overall December forecast is negative, any sale will be welcome. If you’re not in a rush and have some ADR flexibility, try maximising direct sales by reducing rate plans in OTAs on your highest‑occupancy days.

In resort hotels, your biggest potential is spring/summer depending on your destination. Offer stronger web‑only conditions to maximise sales vs OTAs, what’s booked via Booking for summer is very likely to be cancelled. Tighten minimum stays in that channel and, above all, protect your best room types, offering them only on your website.

5. Length of stay: the website triples long‑stay sales vs OTAs

The campaign is mostly short (1–2 nights: 58%) and medium stays (3–5: 33%). Even so, the direct channel concentrates more long stays than OTAs: it generates 39% more 6–8‑night stays than Booking and 52% more than Expedia. For stays over 9 nights, the difference is even greater: +204% more bookings than Booking and +194% than Expedia.

In resort hotels, the big difference appears: 20% of direct channel bookings are 6+ nights, while in Booking and Expedia it’s less than half of that. Key correlation: we already saw that the direct channel pre‑sells summer better and cancels less; here it also lengthens the stay making it the most profitable channel for resorts. In LATAM, we generally see longer stays and a bit more parity between channels.

Action. If you already have the best web price, you’re halfway there. But you can do more. Communicate clearly on your website to promote long stays during the campaign, concentrating your strongest value proposition there (Club, plans and room types exclusive to your site during key months…), and steer OTAs toward short stays (1–2 nights) by limiting their selling capacity via availability and restrictions.

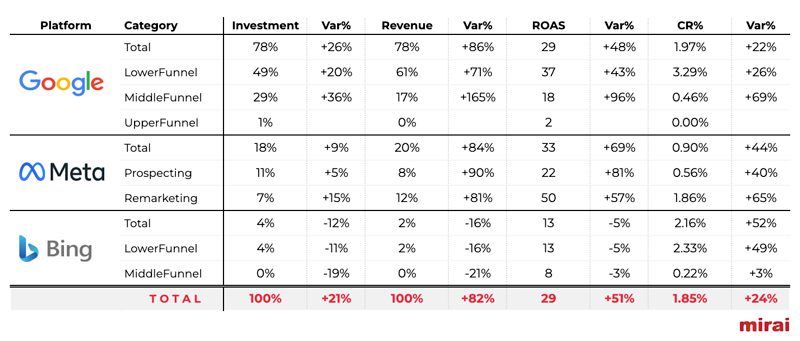

6. Campaign performance: maximise visibility at the best ROAS

We compared how hotels invested in their direct channel for Black Friday 2024, and the results are clear. If we compare the investment during the campaign (20 November to 3 December) against the same period of the previous month, we see that with a +21% increase in spend on Google, Meta and Bing, revenue grew 82%, with a ROAS of 29 (+51% vs previous period) and a conversion rate of 1.85% (+24%). You can also break down results by campaign type:

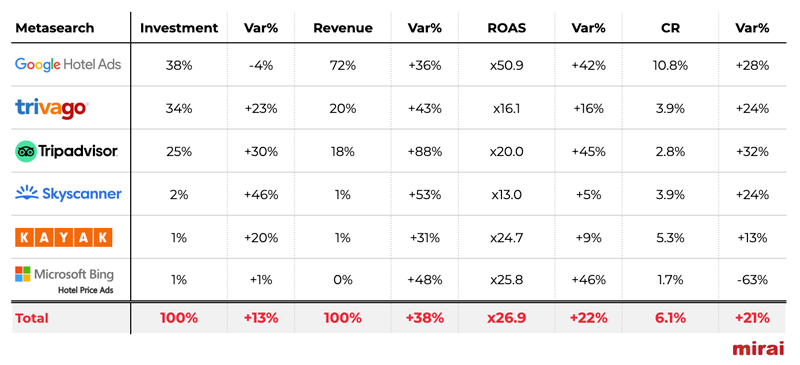

In Metasearch, investment rose by 13%, with generated revenue up 38%, ROAS at 26.9 (+22%), and conversion at 6.1% (+21%), with Google Hotel standing out at ROAS 50.9 (+42%) and conversion 10.8% (+28%).

Action. Ensure your website’s visibility by increasing or removing limits on your investment during these days, as the rise in ROAS and conversion will clearly boost your sales. Try to pivot budget prioritising Google (Lower+Middle Funnel with demanding tROAS) and Meta Remarketing, and keep Bing only for brand/core. In Metasearch, push Google Hotel Ads (and test Tripadvisor as a second) with strong bids only when your website leads on price/parity.

7. Sales by hour and channel: lean into the morning, watch the night

The peak sales hours are from 10:00 a.m. to 9:00 p.m. The direct channel accelerates early (10–13 h) and keeps pace with peaks (16–19 h); Booking gains ground at the end (20–22 h) and Expedia dominates the early hours (00–07 h), partly due to US market impact. Key takeaway: there’s a clear improvement window for direct between late afternoon and prime time, while the overnight tail is Expedia territory, though clearly smaller in weight. In LATAM, there’s generally a bit less late‑night booking activity.

Action. With an optimal price differential throughout the campaign you shouldn’t have problems. But if you run your campaign based on price parity, at least try to improve your direct channel’s competitiveness on price, availability and conditions, protecting yourself from Expedia overnight and from Booking in the final hours of the day. Monitor your website price the rest of the day to guarantee it remains the best.

Conclusion

Participating in Black Friday isn’t about cutting prices: it’s about taking advantage of the year’s highest intent peak to gain share in the direct channel. Our analysis shows that, with the right strategy, you can build a bookings cushion for winter/spring that lets you begin the year calmly, without last‑minute discounts or yielding margin to OTAs. There’s a clear competitive effect: if you sit out, your competitor captures that demand; if you play it well, you capture share that isn’t yours today.

The rule is simple: ensure your website offers the best price and conditions, and control distribution so that every booking of value flows to your hotel, not to the OTAs. You’ll strengthen your direct channel and your profitability.