Resort fees are under increasing pressure from regulators, OTAs and consumer expectations. While some advantages remain, most of the original benefits have eroded. This post helps you evaluate whether to retain or eliminate resort fees and how to do it effectively either way.

Resort, Destination, or Service fee: It’s all the same

The term “resort fee” originally referred to additional charges covering amenities such as access to the gym, pool, towels and Wi-Fi. Over time, the term evolved to “destination fee” or “service fee” as non-resort properties adopted similar practices. For simplicity, we’ll use “resort fee” throughout this article to refer to all such surcharges.

Is the resort fee actually room revenue?

Yes, for two main reasons:

- Taxation: Resort fees are taxable. While they may bypass online travel agencies (OTAs), they do not escape tax authorities such as the Internal Revenue Service (IRS).

- Mandatory Nature: Have you ever tried to refuse a resort fee because you didn’t use the gym or pool? It’s rarely, if ever, allowed. These fees are mandatory, which further supports their classification as room revenue.

A quick guide: keep or drop resort fees

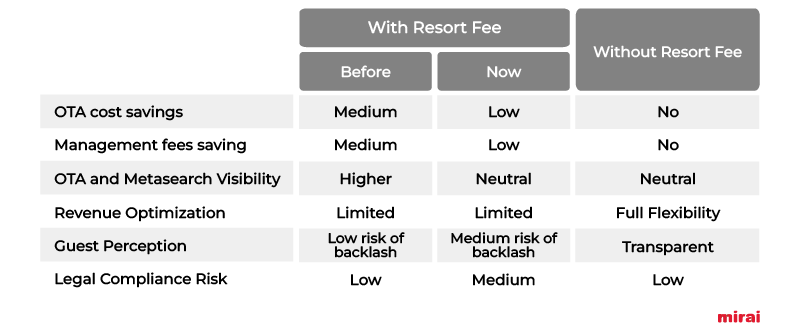

Before deciding whether to continue charging resort fees, it’s worth revisiting the original rationale and examining whether those benefits still apply today.

- Reduced OTA commissions:

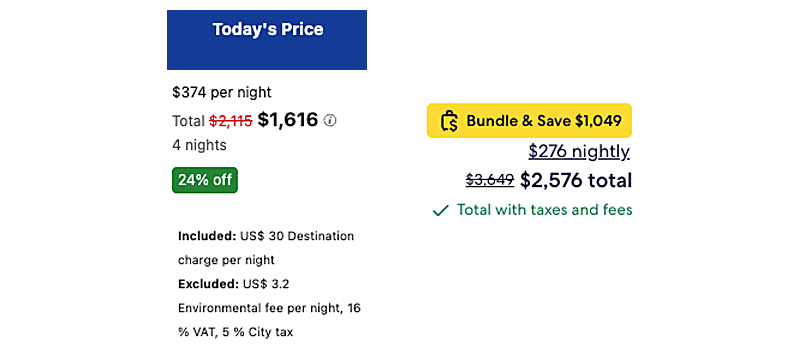

Until now: OTAs used to charge commissions on room revenue, but not on taxes and fees. By shifting part of the room rate to resort fees, hotels could reduce commission payments significantly.

What has changed? Booking.com, the world’s largest OTA, began charging commission on resort fees, eliminating much of the cost advantage. While Expedia generally does not charge commission on resort fees, this can vary depending on the specific program or payment model.

- Lower brand management fees:

Until now: In addition to OTA savings, many hotel brands charged management fees based only on room revenue. Resort fees were excluded, another financial win.

What has changed? Today, most major brands (Marriott, Hilton, Hyatt) include resort fees in their fee calculations, although exceptions may still exist based on specific contract terms.

- Gaming OTA sorting algorithms:

Until now: Resort fees allowed hotels to appear cheaper in OTA search results, improving visibility and click-through rates. The actual price -including fees- would only appear during checkout, often going unnoticed.

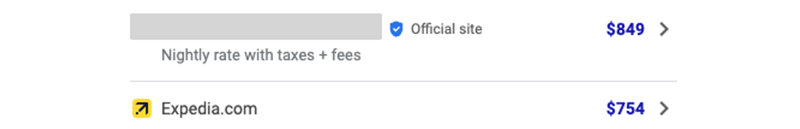

What has changed? This loophole has been largely closed. In the U.S. Booking.com now displays prices inclusive of resort fees, while Expedia goes a step further by showing the total price -including all taxes and fees- early in the booking process. Let’s remember the OTAs largely already showed final prices outside the U.S.

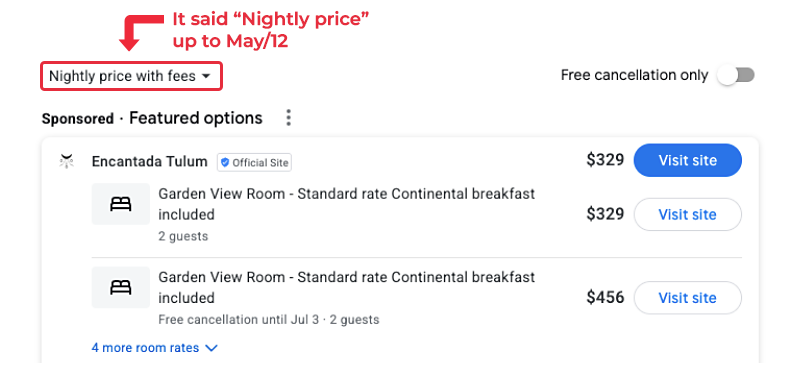

In the U.S. Google Hotel Ads did not include fees but, since May 12, it also shows room prices including mandatory non-governmental fees and excluding only taxes,, neutralizing the value added of resort fees.

- Customer satisfaction and expectations:

Until now: Customers were often blindsided by unexpected fees during checkout. This caused frustration, but many booked anyway.

What has changed? Today, consumers have a stronger voice. Negative reviews over hidden charges can have serious reputational consequences. Transparency is now essential: guests want to see the total price upfront, including all taxes and fees.

- Legal and regulatory pressure:

Until now: Regulators focused on larger issues and pricing transparency in travel was not a priority.

What has changed? Regulatory scrutiny has increased. In the European Union and countries like Mexico, showing the final price upfront is legally mandated. U.S. states such as California and Minnesota have adopted similar rules. Other states are following suit. The Federal Trade Commission has proposed legislation to mandate full price transparency, although it has not yet been enacted at the federal level.

- Impact on revenue management and operations

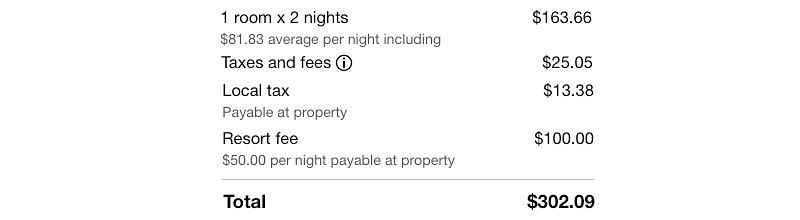

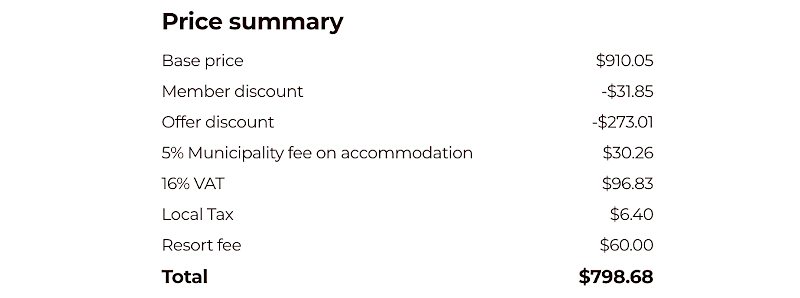

Until now: Resort fees have always presented challenges to revenue managers. These fixed per-night fees cannot be dynamically adjusted in channel managers, reducing pricing flexibility, particularly in low-demand periods. In such cases, the fee can represent a disproportionately large share of the total price, confusing and annoying guests. In the following example, the resort fee represents 61% of the total room revenue. Can effective revenue management really be achieved with only the remaining 39%?

Beyond pricing complexity, resort fees often create operational headaches, from front desk disputes to discrepancies in financial reporting.

What has changed? Nothing. Resort fees continue to be a headache for both revenue and operations teams limiting optimization strategies.

Best practices for managing resort fees

If you choose to continue using resort fees, it’s critical to do so responsibly and transparently. Follow these key guidelines:

- Ensure transparency

Display the total price, including taxes and fees, on the first step of the booking engine. Provide a clear breakdown at checkout. This builds trust and meets legal and customer expectations.

- Align with Google Hotel Ads policies

Confirm that your metasearch partner distinguishes correctly between taxes and fees. Improper labeling may trigger Google to flag your listing as “with extra fees,” making it look less competitive than OTAs.

- Avoid Google Hotel Ads campaign suspension

Google may pause campaigns that fail to show all fees and taxes on the landing page. Follow all display and landing page requirements to maintain ad visibility.

- Keep fees proportionate

If the resort fee becomes too large relative to the base price, it undermines pricing logic and hampers your revenue manager’s ability to remain competitive.

In Summary

Resort fees were once a smart financial strategy. Today, their value has significantly diminished but not disappeared entirely.

If you decide to sunset your resort fee and reintegrate it into room revenue, the benefits may include operational simplicity, improved guest satisfaction, and reduced legal or reputational risks.

If you choose to retain the fee, ensure full transparency, especially on your direct channel and monitor your compliance with customer expectations, OTA policies and evolving legal requirements.