Many hotels do the right thing by offering better stock and price conditions to Booking.com, and of course to their own website, rather than to Expedia after seeing that they make more money that way, since the net price (after taking out the commissions) is almost always superior.

However, rarely are these same decisions made depending on cancellations and the costs that these generate per channel. It’s not easy to estimate or measure this cost since it doesn’t leave a direct trail (albeit an indirect one) on the average price or production of each channel, but we should not ignore it nevertheless.

We will analyse these costs as well as determine who is responsible for the fact that cancellations are shooting up: the hotel or the channel?

Do cancellations vary subject to the channel?

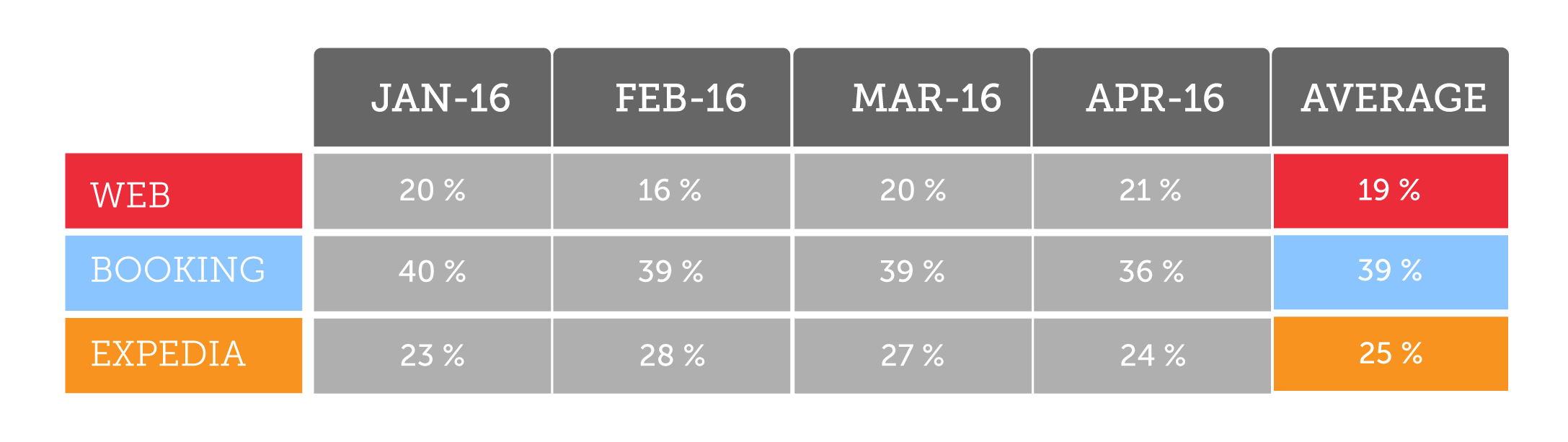

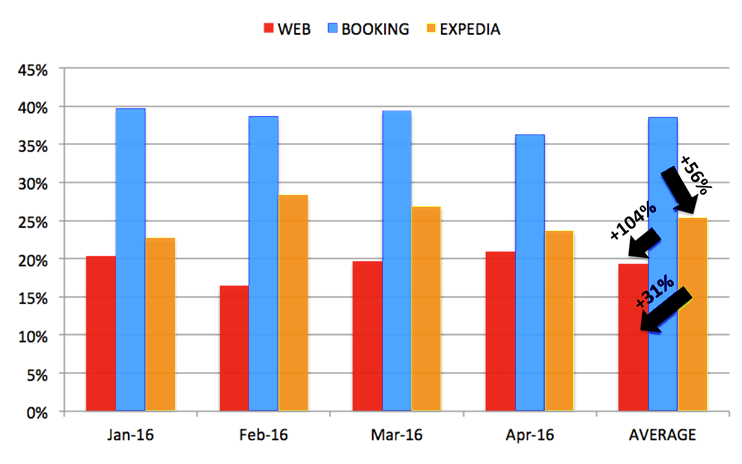

We have chosen 40 of our channels and analysed the cancellations (% on room nights) in the last four months (January-April 2016) of our three most important online channels: Booking.com, Expedia and the website itself. The results are as follow:

According to our analysis, the Booking.com cancellations are 104% more than the direct channel ones, while they are 31% up in the case of Expedia. The relation between Booking.com and Expedia is +56% in favour of the former.

It’s important to note that Expedia’s cancellation varies a lot subject to the model that hotels are using. The cancellation of the Package rate is very low, less than 3% (airline rates are mostly non-refundable); the Expedia Collect (Expedia charges the client) cancellation rate is around 12% and the Hotel Collect (pay directly at the hotel) cancellation rate is close to Booking.com levels at around 35%.

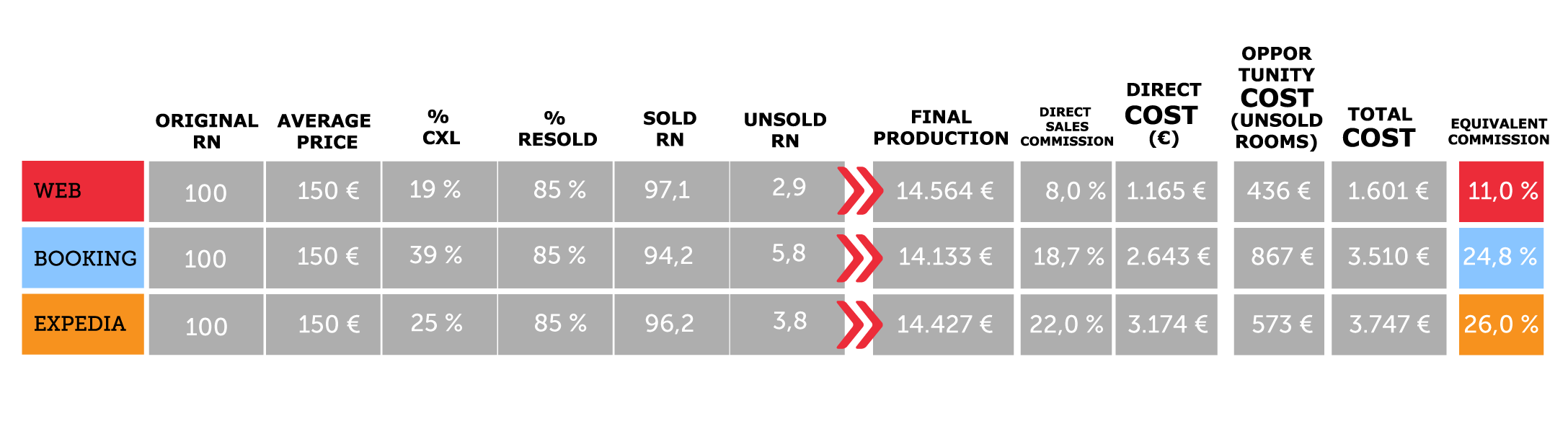

An example will help to better illustrate how distribution costs vary per channel if we take the opportunity cost into account had we not sold any of the rooms after the cancellations.

Let’s work with 100 room nights generated by each channel at a price of, let’s say, 150€. We then assign the resulting cancellation percentage from our analysis to each channel. We assume 85% recovery of these cancellations (an optimistic percentage), in other words, that the hotel manages to sell them through the same channel after the cancellation and that they can still maintain the sale price of 150€. After adding this opportunity cost, we see how the final commission of Booking.com would go up to 24.8% (increasing by 4 points), the Expedia one to 26% (increasing by 4 points) and lastly the website one (in which we assume 8%) which would go up to 11% (+3 points).

These numbers would vary in the different hotels. We invite you to make this calculation in your particular case and to start assigning cancellation costs to each channel in order to have a more complete picture of your distribution.

Why is Booking.com the channel with the most cancellations?

If the hotel applies the same cancellation restrictions to the three channels equally, why are the results so different? We believe that the reasons are as follow:

- Fraudulent bookings. The truth is that most of these bookings (like, for example, to obtain a visa to enter a country) go through Booking.com, since it’s the most popular and important OTA in the world. These are bookings that the hotel usually identifies as fraudulent and cancels on the spot, therefore with little impact.

- Payment method. Expedia generates many of its bookings in the Expedia Collect mode, where Expedia charges the client directly (not necessarily non-refundable). It has been psychologically proven that you pay in advance when you are sure that you will be going, and therefore have less of a chance of cancelling. Also, this payment method avoids any kind of fraudulent booking.

- Package rates. A high percentage of Expedia bookings (depends on the hotel) include a flight, which is usually a non-refundable rate. The cancellation of these bookings is, therefore, very low, thus considerably reducing Expedia’s cancellation average. It would seem fairer to compare Booking.com with Expedia in its mode of paying directly at the hotel, although unfortunately the data that hotels have is not always broken down in this way, thus making it very difficult to measure.

- OTAs work more on inspiration. The hotel doesn’t with its website. Mail marketing campaigns are commonplace to generate booking interest. Many clients end up doing so but, since it’s so casual, they book first and then see if they have time and money to actually go. In any case, cancellation is free. The inspiration phase is still far from the booking phase and therefore there is a higher probability that many bookings end up being cancelled.

- Culture of each channel. Booking.com is increasingly encouraging clients to book even if they’re not sure that they will travel. For that, it employs dozens of booking accelerators that pressure clients with a message such as “book now or you’ll lose the room”. Here is a message that it regularly sends to its clients:

This speculation suits Booking.com. Even if many rooms are cancelled, many won’t be. The hotel will most likely use Booking.com again to sell them, since it is the channel that best works with last-minute bookings.

Booking.com itself made a test some time ago where it notified the client when the hotel lowered its booking price (so that the client would cancel and make a new booking). This is an excellent service for the client but it was not received with open arms by the hotels, who themselves had an answer to it: make all rates non-refundable. In the end, Booking.com stopped this practice but it’s still active on www.tingo.com, www.triprebel.com and www.yapta.com

The traditional OTA discourse is that the final result is what matters and it ends up benefitting the hotel if it’s a positive one. Cancellations aren’t a problem. This statement is only partially true and supports itself on how hotels fail to calculate the impact of cancellations.

- The hotel-website client is different. Our experience tells us that this client is the most loyal client to the hotel and, therefore, speculates less. If he books at your hotel, he almost always goes (unless he has a setback).

The truth is that Booking.com knows that all of these cancellations are a problem for the hotel and they are working to reduce their impact. For that, they recently introduced two new tools to facilitate charging the bookings from their extranet and there seem to be movements to exempt the hotel of non-payments by clients, with Booking.com taking on that risk. The latter seems like a great move by Booking.com. We will await more details on the matter.

What to do to take into account the cancellations of each channel?

As we’ve seen, even if you apply the same distribution strategy and cancellation restrictions, each channel will have a different percentage and cancellation notice period. These cancellations are costing you money and you should look to assign them to each channel.

If we penalise Expedia for their large commission (closing sales or increasing prices), we should also do the same to other channels with a higher cancellation impact.

If Booking.com has the largest index of cancellations, you should consider applying a more restrictive cancellation policy in comparison with the rest of the channels, especially in comparison to your own website and particularly during high season. A holiday hotel, for example, would add a 21-day cancellation notice period for its hottest dates on Booking.com (or, directly, non-refundable) and would maintain 7 days on its website. An urban hotel, during dates of high demand, could do the same with 24 h. and 72 h.

The other tool the hotel has is the price. Increase the price on the channels with a higher cancellation rate. If you manage to monetize them in each channels (unsold rooms, average price reduction, staff costs, etc.), and bring it to a total cost, you should add it to the commission of each channel, which would give you a more complete picture of reality. The difference in cost between Booking.com and Expedia would be reduced and, on the other hand, would further increase between OTAs and your own website.

Conclusion

When we compare the costs per channel, we should broaden the analysis and have a global view. Direct commission is just one of the many costs that each channel has. Other ones that are also known, albeit rarely calculated properly, are the yearly/monthly fixed costs and the sales rebate. On the other hand, we rarely include the cancellation costs in this analysis.

If we were able to monetize it, we would realise that the channels that appear to be more profitable are not as profitable as we think. Once again, it continues to show that the direct channel is the most profitable one of them all and one that the hotel should strongly commit its long-term strategy to.

This is a great post. I have a question:

The premise that 85% of cancelled rooms are subsequently resold -is that a data point from analysis of your customers? Or just a working assumption, which you refer to as ‘an optimistic percentage’? If the resale rate is actually lower than this your proposition would be further supported.

So, what would be the actual resale rate, based on the 24-hour cancellation rate currently generally available from OTAs?

Thank you.

Hi John, thanks for your comment. I used 85% as a working assumption, but based on many conversations I had with the hotels we worked with. It is optimistic indeed. So you are right, if the rate is lower, my assumptions would be further supported. But I did not want to base my analysis on a questionable premise.

To your questions, the resale rate is difficult to calculate as it depends on many variables. For instance in downtown Barcelona during 8 out of 12 months, the resale rate is close to 90%. However, in other locations and in low season the resale rate could be close to zero. It’s a difficult analysis, and each hotel should make its own numbers. My point was, however, that hotels should give much more importance to the cancellation rates and the subsequent effects. They should also react to those channels which have higher cancellation rates. Unfortunately, hotels usually do nothing on this respect 🙁