En español, en français, em português.

We continue advancing toward our goal of improving efficiency and profitability for our clients. That is why we are launching a new functionality in Mirai’s booking engine: multi-acquiring by market. This solution is designed to optimize payment management and reduce costs derived from international transactions, as well as adapt to the local market by offering region-specific payment methods (such as Oxxo and financing in Mexico, Bizum in Spain, Klarna, among others). It also allows hotels to collect directly in the local currency if they wish, among other advantages that we will detail below.

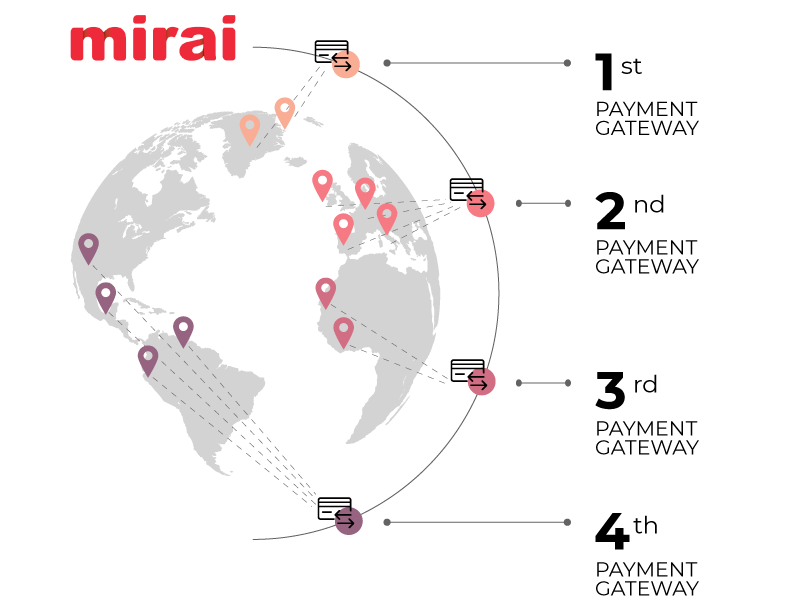

This new feature will allow you to automatically route payments from each booking to the most suitable payment platform and merchant account based on the customer’s country of origin. All of this is managed centrally from the booking engine, automatically and transparently.

How does it work?

The system detects the customer’s country during the booking process and applies the corresponding routing logic, directing the payment to:

- A specific payment gateway per country or group of countries.

- A specific merchant account within a gateway, if desired, per country or group of countries.

This enables more precise management, adapted to the particularities of each market, without losing the efficiency of centralized operations.

What advantages does it offer?

Here’s how this functionality translates into concrete benefits for your hotel:

1. Lower fees on international transactions

By using local processors in each market, you will not only minimize cross-border transactions but also significantly reduce associated costs.

2. Optimized collections in the customer’s currency

Using a market-specific payment processor also allows you to collect in the customer’s currency (not necessarily your hotel’s), reducing costs by avoiding exchange rates. These funds can later be used to make payments in the same currency, again avoiding exchange rate fees.

3. Greater configuration flexibility

You will be able to use multiple payment gateways, and even multiple merchant accounts within the same payment platform, adapting to the specific conditions of each market or financial institution.

4. Improved customer experience

Activating alternative payment methods by country and payment platform, including local exclusives, facilitates conversion, increases authorization rates and enhances the end customer’s purchasing experience.

| COUNTRY | EXCLUSIVE LOCAL METHODS | BNPL |

|---|---|---|

| Spain | Bizum | Klarna, Aplázame, Sequra |

| United Kingdom | Open Banking | Klarna, Clearpay (Afterpay), Laybuy |

| France | Cartes Bancaires, Lydia | Klarna, Alma |

| United States | Venmo, ACH, Zelle | Affirm, Afterpay, Klarna, Zip |

| Germany | Klarna Pay Now | Klarna, Ratepay |

| Portugal | MB WAY, Multibanco | Klarna (limited presence) |

*BNPL (Buy Now Pay Later): Split or installment payment option

5. Smoother payments for local customers

When applicable, collecting in the local currency is fast and frictionless, improving both conversion and customer satisfaction.

6. Test payment platforms risk-free without changing your operations

If you want to test a new payment platform, you can now try it safely in a secondary market and compare its performance with your current provider—without compromising your main operations.

7. Conversion optimization in Non-PSD2 markets

For hotels heavily dependent on customers from countries where PSD2 regulations do not apply (such as the US, Canada, Australia, or much of Latin America), and where 3D Secure penetration is low but gateways have it enabled by default, multi-acquiring allows you to:

- Test another provider that facilitates conversion with alternative/local methods.

- Avoid authorization/acceptance issues caused by 3D Secure friction in markets where customers are not accustomed to it. Currently, this can lead to lost bookings. Security is key to preventing fraud, but in these markets, low 3DS penetration creates significant conversion friction.

8. Reduced operational and financial risk associated with currency exchange

By managing collections and balances in multiple currencies through local payment methods, you can reduce exchange risk by avoiding redundant conversions. This is especially useful for chains operating in multiple regions and managing budgets or supplier payments in different currencies.

9. Improved accounting reconciliation and financial reporting by country or currency

By routing payments by country and account, you can better automate reconciliation and obtain more precise financial reports segmented by market. This simplifies accounting, auditing and profitability analysis by country.

A step further toward more strategic payment management

Multi-acquiring by country is not just a technical improvement but a significant evolution in how your hotels manage payments. It represents a key advancement for a more efficient, profitable and globally adapted collections strategy.

This new functionality not only optimizes costs and current operations but is also a key strategic lever for your hotel’s expansion. By offering local payment methods and removing barriers, it allows you to access new markets and attract travelers you couldn’t reach before, boosting competitiveness, diversifying revenue, and ensuring sustainable global growth.

In summary, this functionality allows you to:

- Reduce transaction and currency exchange costs.

- Increase conversion and customer satisfaction.

- Adapt to the particularities of each market.

- Test new payment platforms risk-free.

- Centralize and automate payment management.

- Access new markets more optimally.

I’m interested in activating multi-acquiring by market—What do I need to do?

You only need to contact your Account Manager. We will help you analyze your current operations, configure the necessary payment platforms and accounts and resolve any questions so you can get the most out of this new functionality.